Shares of social media and technology giant Meta Platforms (NASDAQ:META) continue to be in the spotlight. In a recent development, the company has confronted the U.S. Federal Trade Commission (FTC) for unilaterally altering a consent agreement regarding privacy violations involving Meta’s subsidiary, Facebook.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company said it voluntarily reported two technical errors associated with its Messenger Kids app to the agency and promptly addressed them. Additionally, the company took extensive measures to strengthen its privacy program, including a significant investment of $5.5 billion between 2019 and 2023.

Notably, a U.S. court recently allowed the FTC to investigate Meta Platforms for privacy breaches. The investigation stems from allegations in May 2023 that Meta misled parents about control over children’s activities in the Messenger Kids app. The FTC seeks stricter regulations on Meta, including banning data monetization from users under 18 and expanding limits on facial recognition technology.

META Stock Continues to Rise

Despite growing regulatory risks, Meta stock continues to grow and hit a record high of $530 on Thursday, April 4.

This came after Jefferies analyst Brent Thill raised his price target on META stock to $585 from $550. The analyst maintained a Buy rating on META stock and expects the company to capture additional industry advertising dollars in 2024. Thill projects Meta’s advertising revenue to grow by 20% in 2024, much higher than the industry average of 9%.

The analyst attributes this optimistic outlook partly to Meta’s integration of generative artificial intelligence (AI) technology into its products, which is expected to bolster its competitiveness in the advertising sector.

Despite initially reaching a record high, Meta’s stock eventually relinquished most of its gains, closing just 1% higher.

Is Meta a Buy, Sell, or Hold?

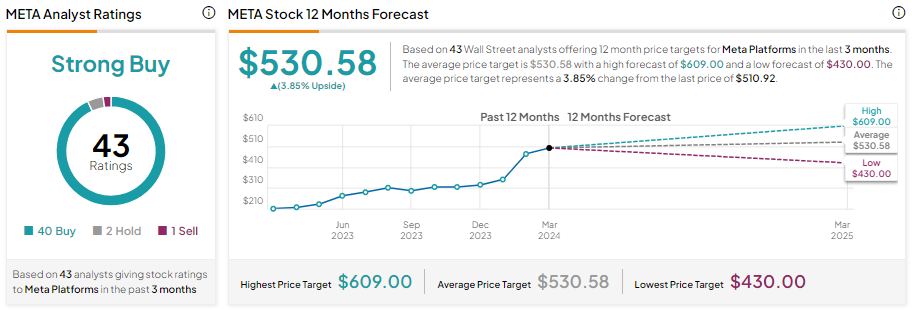

Meta stock has increased 142% in one year and is up about 44.5% year-to-date. Despite this notable gain, Wall Street is bullish about Meta stock. It has a Strong Buy consensus rating based on 40 Buys, two Holds, and one Sell recommendation. Analysts’ average price target on META stock is 530.58, implying 3.85% upside potential.