Shares of the social media and technology company Meta Platforms (NASDAQ:META) are down about 13% in Thursday’s pre-market session. The soft Q2 revenue guidance and concerns around the significant increase in artificial intelligence (AI) investments irked investors. Following the Q1 earnings release, analysts largely maintained their positive outlook and suggested buying META stock, despite some adjusting their price targets downward.

With this backdrop, let’s delve into some of the analysts’ comments.

Analysts Suggest Buying Meta Stock

Barclays analyst Ross Sandler reiterated his Buy recommendation on Meta stock after the Q1 earnings report. The five-star analyst noted that Meta’s earnings call did not reveal any major red flags. However, he decreased his price target to $520 from $550.

Echoing confidence in Meta stock, Goldman Sachs analyst Eric Sheridan also maintained a Buy rating on META stock. Sheridan expects short-term volatility for Meta but remains optimistic about Meta’s leadership’s ability to navigate significant investment cycles and drive long-term success.

However, the analyst cautioned that tough comparisons and rising operating and capital expenses may weigh on Meta’s financials. As a result, Sandler lowered the price target to $500 from $550 per share.

What Is the Forecast for META Stock?

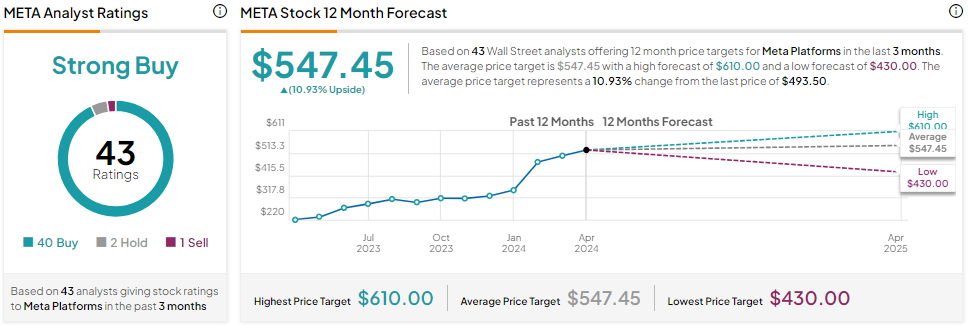

Wall Street analysts are bullish about Meta’s prospects. Meanwhile, 10 analysts reiterated a Buy on the stock after the Q1 earnings call. Overall, 40 out of 43 analysts covering Meta stock recommend a Buy. Two analysts have a Hold, and one suggests a Sell.

Meta stock sports a Strong Buy consensus rating. It has gained over 138% in one year. Analysts’ average price target on Meta stock is $547.45, implying 10.93% upside potential from current levels.