Shares of U.S. tech giant Meta Platforms (META) fell during early trading on Tuesday after reports suggested that the European Union was making moves to ensure that its private messaging platform WhatsApp follows the bloc’s stricter content moderation policy.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

According to Bloomberg, the European Commission, the bloc’s executive branch, has sent a letter to Meta notifying it of plans to designate its public-facing ‘channel’ feature as a “Very Large Online Platform” under the EU Digital Services Act (DSA). Meta added the open channel feature to WhatsApp in September 2023, enabling public figures, brands, creators, and news organizations to cultivate followers on the private messaging app.

WhatsApp’s Open Channels Near 50M EU Users

The disclosure of the plan follows Meta’s February filing, which reported that WhatsApp’s open channels averaged 46.8 million monthly active users (MAUs) in the EU during the last six months of 2024.

Under the DSA, the EU requires online platforms that have more than 45 million monthly active users to police the dissemination of illegal or harmful content on their platforms and develop plans to reduce such risks. The rules are already applicable to Meta’s apps, such as Facebook and Instagram.

However, the rules do not apply to private communication platforms, which indicates that WhatsApp’s core messaging feature might be exempted from the policy. The penalty for contravening the rules can go up as much as 6% of the offending platform’s annual global revenue.

EU’s Big Tech Crackdown Tests U.S. Diplomatic Bond

The development comes as the EU continues to crack down on Big Tech companies, straining diplomatic relations with the Trump-led administration, particularly in relation to tariffs on trade and digital services. Last month, the EU extended its child safety probe into Meta to include other U.S. tech majors such as Apple (AAPL), Alphabet (GOOGL), and Snap (SNAP).

Is Meta Stock a Good Buy Now?

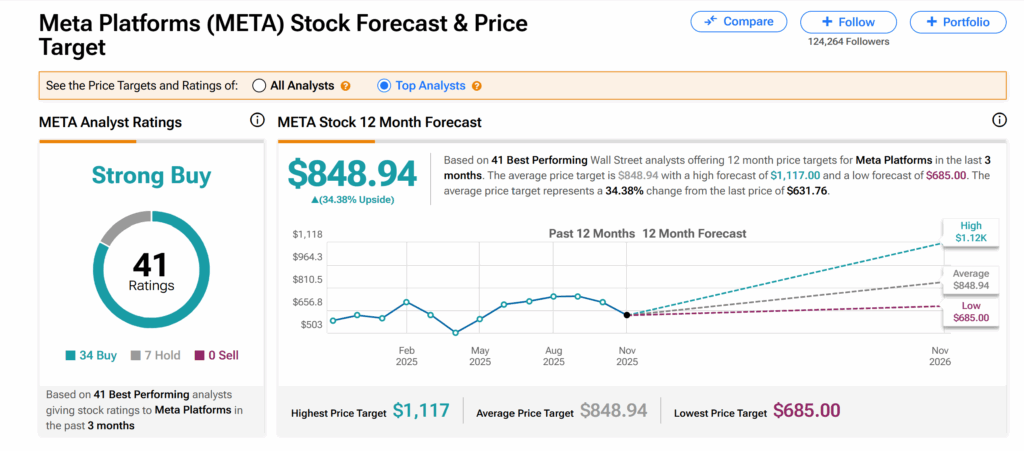

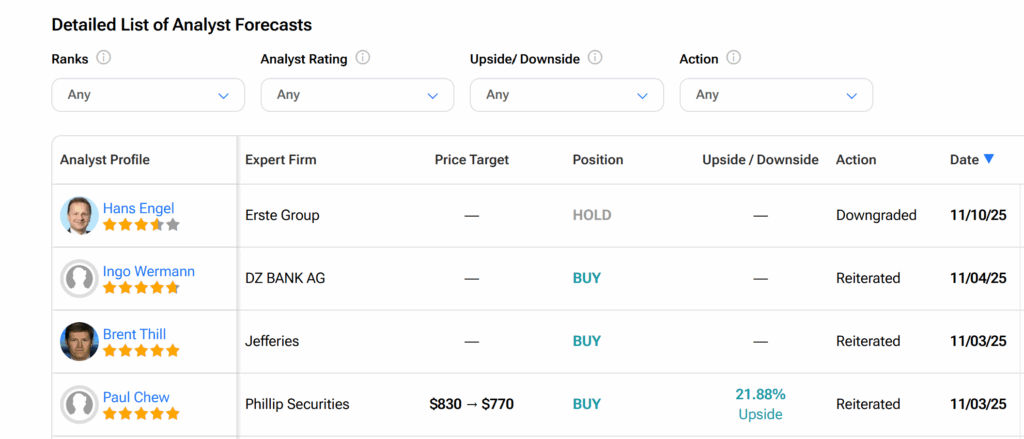

Turning to Wall Street, Meta’s shares currently have a Strong Buy consensus rating, according to TipRanks’ data. This is based on 34 Buys and seven Holds issued by 41 analysts over the last three months.

Furthermore, at $848.94, the average META price target points to more than 34% growth potential from the current trading level.