There’s potential trouble ahead for almost every social media stock out there, warns Meta Platforms (NASDAQ:META), and not even Meta itself is immune. More specifically, it’s a matter related to digital advertising and how the market for such ads is in open decline. That’s likely to drive share prices down, and indeed, Meta took quite a hit. It’s down over 4% in Thursday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Things looked good for Meta at first, especially as it rolled out its earnings report yesterday, complete with a revenue figure of $34.15 billion, a jump of 23% against the same time last year. That looks particularly good against Meta’s spending, which came out to around $20.4 billion, down 7% from this time last year.

But it was the projections that proved problematic for Meta, noting that the fourth quarter started off strong, but there was “more volatility” than normal for a quarter’s start point. Meta attributes that, at least in part, to the Israel-Hamas war.

Weakness in the digital ad market has, at least on some fronts, been a thing since early this year. Back in February, Modern Retail was reporting on a slump in the digital ad market, starting with a drop in Alphabet’s (NASDAQ:GOOG) (NASDAQ:GOOGL) Google arm. Google saw a 3.6% decline in advertising revenue.

While it still came in at $56 billion, that was still down from the $61.23 billion seen in the fourth quarter of the previous year. With the consumer in decline, as they face staggering inflation, advertisers are pulling back, knowing too many ads will fall on deaf ears to make advertising pay in the short term.

Is Meta Stock Still a Buy?

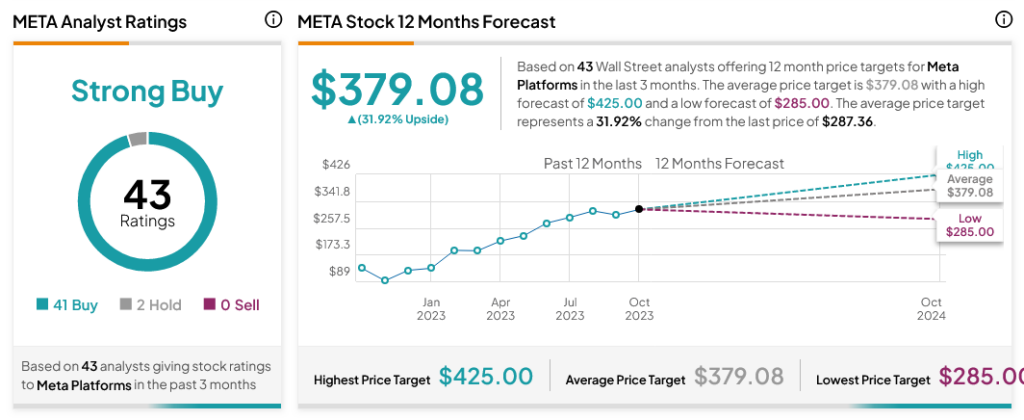

Turning to Wall Street, analysts have a Strong Buy consensus rating on META stock based on eight Buys, three Holds and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average META price target of $379.08 per share implies 31.92% upside potential.