Social media giant Meta Platforms (NASDAQ:META) will release its Q1 2024 financials on Wednesday, April 24. Solid engagement across its apps, improving ad demand, and enhanced efficiency will likely drive its top and bottom lines in Q1.

With this backdrop, let’s look at the Street’s consensus estimates for Q1. But before that, it’s important to highlight that Meta’s efforts to drive engagement on its platform, investments in Artificial Intelligence (AI) technology, and higher advertising revenue have led to a rally in its share price. Meta stock has gained 126.6% in one year, significantly outperforming the S&P 500 Index (SPX).

META – Q1 Expectations

Wall Street analysts expect Meta to post revenue of $36.11 billion in Q1, up about 26% year-over-year. The company’s top line could continue to benefit from higher Family of Apps ad revenue in Q1, led by the strong demand from online commerce and gaming.

Higher sales and operating efficiency will likely drive its Q1 earnings higher. Analysts expect Meta to post earnings of $4.31 per share in the first quarter, up substantially from $2.2 in the prior-year quarter.

Website Traffic Showed Growth

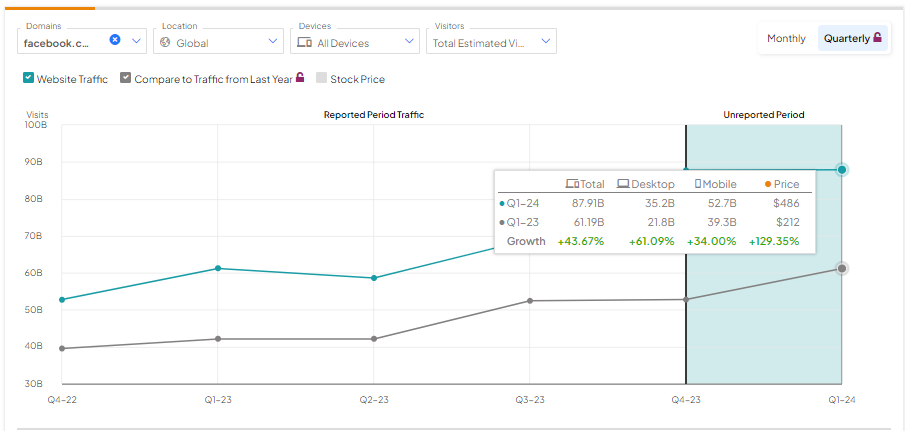

Meta’s focus on improving engagement is reflected through the ongoing growth in Reels and overall Video offerings. Moreover, TipRanks’ website traffic screener reveals that META’s traffic increased substantially year-over-year in Q1.

According to the tool, the number of visits to its platform (including facebook.com, instagram.com, and others) increased by 43.67% year-over-year in Q1.

Learn how Website Traffic can help you research your favorite stocks.

Analysts Upbeat Ahead of Q1 Earnings

Monness analyst Brian White maintained a Buy rating on Meta stock on April 15. The analyst believes that Meta is in a position to gain from improving digital ad trends and a more streamlined operating cost structure. Further, White expects Meta’s advertising revenue to increase by 27% in Q1.

Echoing similar sentiments, Andrew Boone from JMP Securities, Justin Patterson from KeyBanc, Ross Sandler from Barclays, and Brad Erickson from RBC Capital reiterated a Buy on META stock ahead of Q1 earnings.

Is META Stock a Buy, Hold, or Sell?

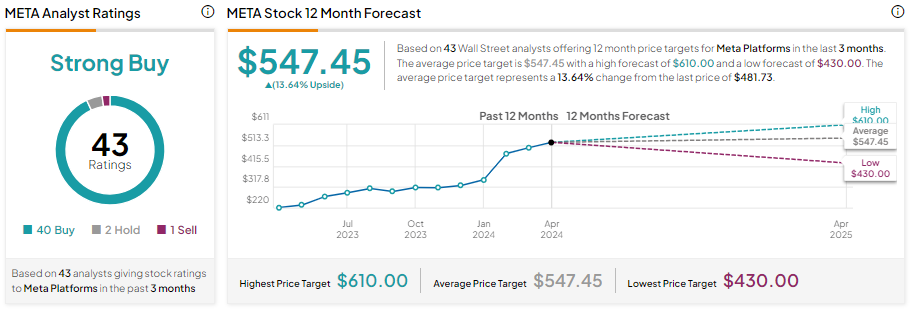

Wall Street analysts are upbeat about Meta stock ahead of Q1 earnings. Meta stock has a Strong Buy consensus rating based on 40 Buys, two Holds, and one Sell recommendation. Analysts’ average Meta stock price target of $547.45 implies 13.64% upside potential from current levels.

Insights from Options Trading Activity

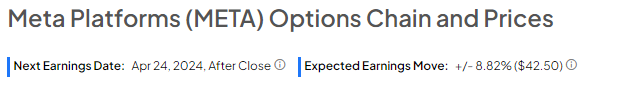

It’s worth noting that options traders are pricing in a +/- 8.82% move in Meta stock on earnings, lower than the previous quarter’s earnings-related move of 20.32%.

The anticipated move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Bottom Line

Meta’s Q1 earnings will likely benefit from the expected increase in ad revenues and the company’s focus on reducing operating costs. Adding to the positives, Wall Street analysts maintain an upbeat outlook ahead of earnings despite the significant appreciation in META stock’s value over the past year.