Meta Platforms (NASDAQ:META) is opposing the European Union’s (EU) “gatekeeper” designation for its Messenger and Marketplace platforms. Meta said that Messenger is not a standalone app, only an offshoot of Facebook, and hence should not come under the Digital Markets Act’s (DMA) purview. Moreover, Meta claims that Marketplace is a consumer product and not a platform to target consumers directly and, therefore, should not be termed a core business. The deadline for challenging the EU’s decision is set for today, November 16.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Interestingly, Meta is not opposing the EU’s decision to term its Facebook, Instagram, and WhatsApp apps as “gatekeepers.” The company noted that the appeal is simply to clarify certain points that designate Messenger and Marketplace under the DMA. The company will continue to comply with DMA rules. Notably, Chinese tech giant ByteDance’s TikTok has also appealed to overturn the EU’s decision to bring TikTok under the DMA’s purview.

EU Brings U.S. Tech Giants under DMA’s Purview

EU’s new Digital Markets Act seeks to label large, powerful apps and marketplaces as “gatekeepers,” aiming to make the online platforms more competitive. The DMA intends to impose stringent rules for big tech companies and enable users to easily switch from one app to another. The DMA termed 22 services, mostly belonging to American tech behemoths, as “gatekeepers” in September.

The DMA is set to go into effect in the first quarter of 2024. Other tech companies, including Apple (NASDAQ:AAPL), Amazon.com (NASDAQ:AMZN), and Microsoft (NASDAQ:MSFT), have not yet challenged the new rule. The DMA requires companies with over 45 million monthly active users (MAUs) and a market cap of 75 billion euros to qualify as “gatekeepers.”

Is Meta Good to Invest In?

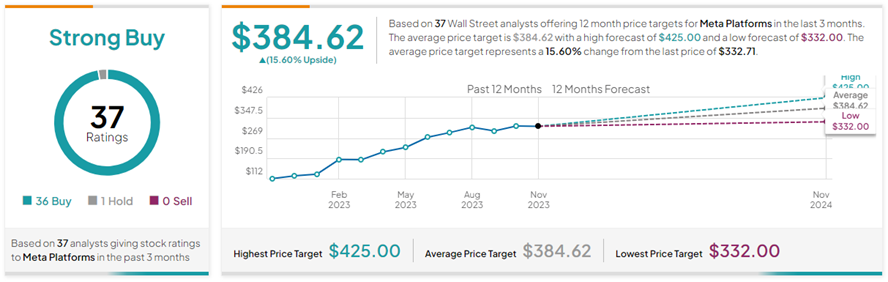

With 36 Buys and one Hold recommendation, META stock commands a Strong Buy consensus rating. On TipRanks, the average Meta Platforms price target of $384.62 implies 15.6% upside potential from current levels. Year-to-date, META stock has gained 166.7%.