If you think the phrase “catastrophe” might be overly dramatic when talking about Mersana Therapeutics (NASDAQ:MRSN), then consider: this biotech stock lost 78% of its value in Thursday afternoon’s trading, and it’s all thanks to one of the worst things that can happen to a biotech stock: a misfire on a drug test.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The problems for Mersana started when it put up its flagship product, upifitamab rilsodotin—otherwise known as UpRi—for testing in its fight against ovarian cancer. Noble cause, sure enough, but the results were nowhere near what Mersana had hoped for. Earlier trials from June found that UpRi came with “bleeding event concerns,” which resulted in a “partial clinical hold” for both trials. Further, Mersana noted that it would halt development altogether of UpRi in the wake of the failed trial.

Mersana then noted to investors that it still has cash sufficient to continue its work until some time in 2027. This projection was helped significantly by Mersana’s subsequent announcement of layoffs. Vast layoffs. Mersana fired fully half its staff in the interests of a “strategic reprioritization.” Reports from Fierce Biotech suggest that Mersana will instead focus on developing dolasynthen and immunosynthen instead. Mersana has some solid work going on elsewhere—one trial that attacks solid tumors is in its dose expansion phase—so it may be able to pull things together.

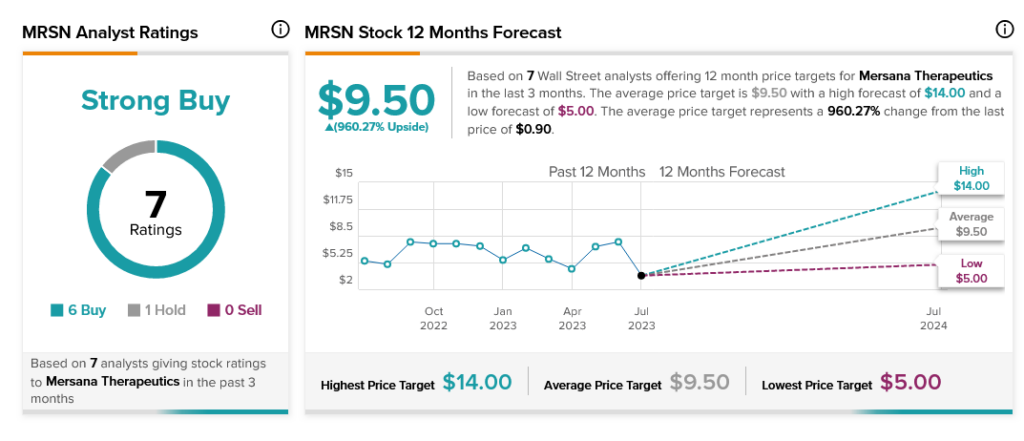

Indeed, analysts look for Mersana to land on its feet. With six Buy ratings and one Hold rating to its credit, Mersana Therapeutics stock is considered a Strong Buy. Further, thanks to this latest pricing action, Mersana Therapeutics stock has a dizzying 960.27% upside potential thanks to its average price target of $9.50 per share.