Normally, when analysts have something positive to say about a stock, that gives the stock a little extra life. In Thursday afternoon’s trading, MercadoLibre (NASDAQ:MELI) advanced itself as the exception that proves the rule, gaining analysts’ favor in one breath and losing over 6% at the time of writing. Hedgeye, via analyst Brian McGough, added MercadoLibre to its “long idea” list, suggesting that the powerhouse name in Latin American e-commerce could have a lot more under the hood than expected. McGough points out that MercadoLibre’s “core markets” are experiencing a “…positive macro inflection…” right now, which is enough to put some extra weight behind consumer spending.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Indeed, MercadoLibre has been gaining ground on several fronts. Investor’s Business Daily hiked its appraisal of MercadoLibre’s relative strength from 88 to 91, though notes that could easily step back given what’s been going on today. Furthermore, Paxos recently hooked up with MercadoLibre to add the Pax Dollar (USDP) stablecoin to its lineup. Now, shoppers can buy in on Pax Dollar via MercadoLibre’s payments system, MercadoPago.

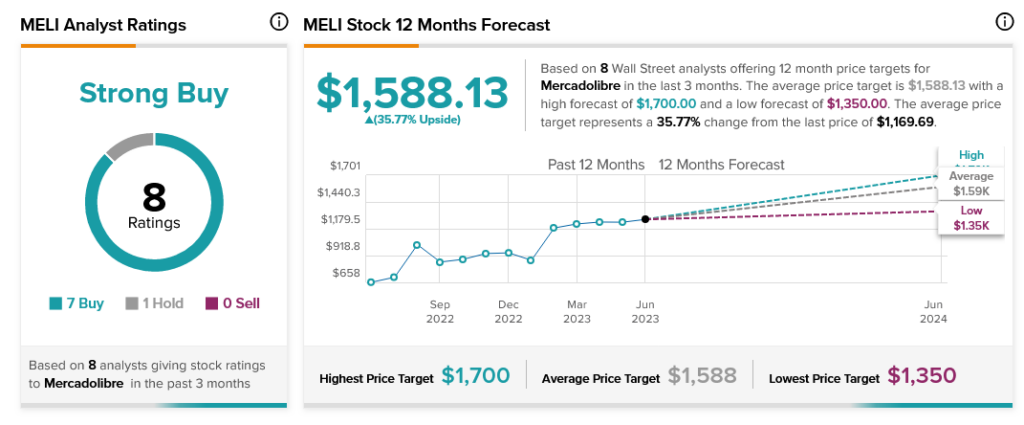

Overall, analysts are nearly universally on board, as seven out of eight analysts call MELI stock a Buy, making it a Strong Buy. The eighth analyst just calls it a Hold. Further, MercadoLibre stock offers 35.77% upside potential thanks to its average price target of $1,588.13 per share.