Medtronic (NYSE:MDT) disappointed investors with unsatisfactory results of its new medical device, Symplicity Spyral Renal Denervation (RDN) System, designed to treat high blood pressure. Nevertheless, the medical device company has moved forward with its application to the Food and Drug Administration for RDN’s approval.

MDT stock declined more than 4% in Tuesday’s early trade. Year-to-date, the stock is down 19.4%.

As per the study results, the device did not meet the primary endpoint. It failed to significantly reduce blood pressure in comparison to the patients who were given only medicines. Medtronic cited “increased medications in the sham control group and the potential impacts of the Covid-19 pandemic on the clinical trial environment” as the reasons for the failure.

That said, the device was successful in meeting a key secondary endpoint – “statistically significant and clinically meaningful reduction in office-based systolic blood pressure.”

The study was conducted on 337 patients with uncontrolled hypertension, enrolled at 42 sites across the United States, Europe, Japan, Australia, and Canada. The patients were divided in 2:1 ratio between RDN and sham control group.

Is Medtronic Stock a Good Buy?

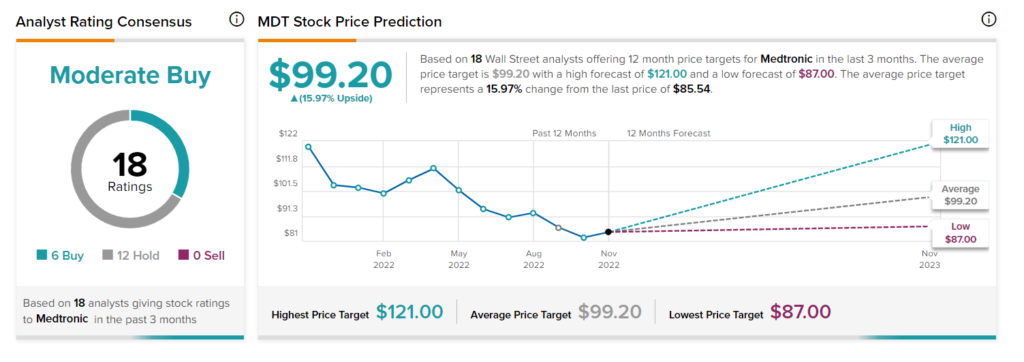

At TipRanks, MDT stock has a Moderate Buy consensus rating based on six Buys and 12 Holds. The average Medtronic stock price target of $99.20 implies upside potential of 15.97%.