Medical Properties Trust (NYSE:MPW) revealed a bold move on Monday: a near 50% slash in its dividend to improve its balance sheet. CEO Edward Aldag outlined ambitions to trim down debts and better position the company financially. This significant dividend cut, dropping to $0.15 from a previous $0.29, aligns with their current strategic adjustments and financial targets, including plans for future investments and a closer look at operational costs.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Furthermore, J.P. Morgan re-evaluated its stance on MPW, downgrading the stock from Neutral to Underweight after MPW’s stock took a hit due to sensitive reactions to tenant-related news. Shares plunged by 15% after a Wall Street Journal piece on Friday, only to rebound slightly after MPW’s counter-response. Michael Mueller from J.P. Morgan highlighted the firm’s growth challenges and cast doubts about the dividend’s long-term viability in his analysis.

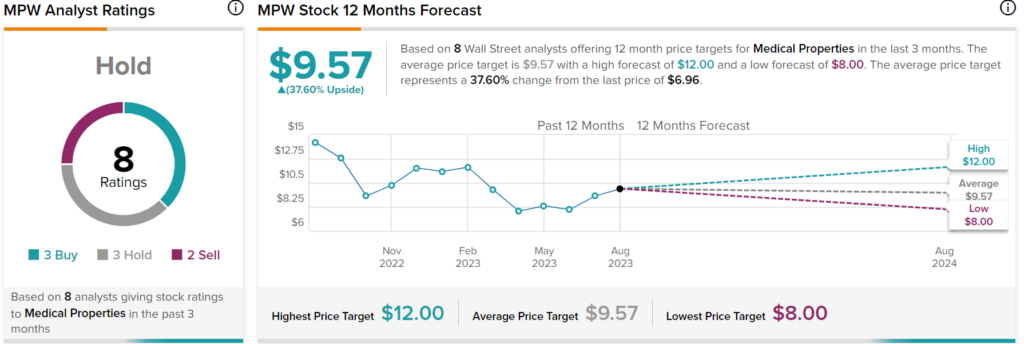

What is the Prediction for MPW Stock?

Turning to Wall Street, analysts have a Hold consensus rating on MPW stock based on three Buys, three Holds, and two Sells assigned in the past three months, as indicated by the graphic above. Nevertheless, the average price target of $9.57 per share implies 37.6% upside potential.