MongoDB (NASDAQ:MDB) delivered better-than-expected results for the Fiscal fourth quarter on robust revenue growth. The company benefited from a 17.2% growth in customer count, driven by strong momentum in the cloud-computing business. However, MDB stock fell 9% in yesterday’s extended trading session on soft revenue guidance for both Q1 and full Fiscal Year 2025.

MDB is a software company that develops a general-purpose database platform.

Q4 Snapshot

MDB reported adjusted earnings per share of $0.86, up from $0.57 per share in the prior year quarter. Also, the reported figure was higher than the analysts’ expectation of $0.46.

Similarly, the company’s revenue of $458 million in Q4 increased 27% year over year and topped the analysts’ estimate of $437 million. The top-line growth was primarily driven by a 28% rise in subscription revenue (97% of total revenues) to $444.9 million.

First Quarter and Fiscal 2025 Outlook

Looking ahead, the company anticipates that Q1 revenue will come between $436 million and $440 million, compared with analysts’ expectations of $452 million. Also, MDB’s adjusted earnings are expected to be between $0.34 and $0.39 per share, versus the Street’s estimates of $0.62.

For Fiscal Year 2025, MongoDB expects revenue between $1.9 billion and $1.93 billion, lower than Wall Street’s expectations of $2.04 billion. Also, adjusted earnings are expected to lie in the range of $2.27 and $2.49 per share, compared with the consensus estimate of $3.27.

Is MDB a Good Stock?

Following the release of Q4 earnings, three analysts rated MDB stock a Buy. Following the release of Q4 earnings, three analysts rated MDB stock a Buy. Among them, Goldman Sachs analyst Kash Rangan believes that the company has provided cautious revenue guidance, despite strong consumer spending trends.

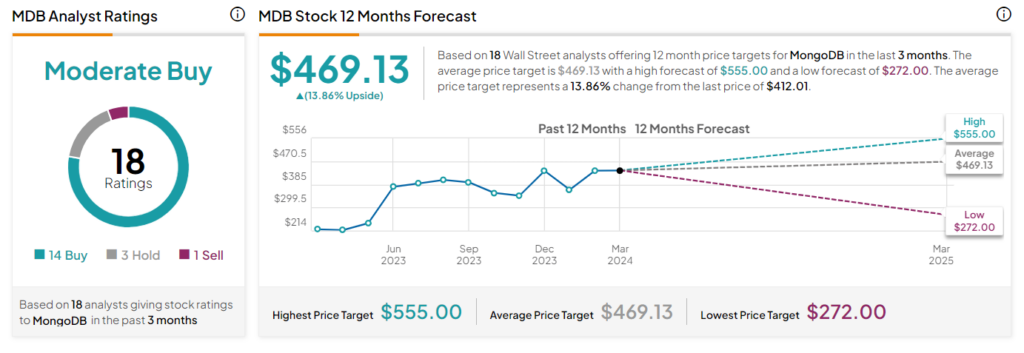

Currently, Wall Street is cautiously optimistic about MDB stock. It has a Moderate Buy consensus rating based on 14 Buy, three Hold, and one Sell recommendations. After a nearly 80% rally in the past year, the average MongoDB stock price target of $469.13 per share implies another 13.9% upside potential.