McDonald’s (NYSE:MCD) tactic to increase brand awareness with celebrity tie-ins has helped boost sales for the restaurant chain in the past. But the recent collaboration with famous rappers Cardi B and Offset has drawn objections from some of the franchise owners, as per a WSJ article.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Several restaurant owners fear that the promotion could bring negative publicity to the brand. Moreover, they argue that the lifestyles and songs released by this married couple do not match McDonald’s family-friendly image. In fact, some of the owners have asked other franchisees to take down any advertisements and merchandise in connection with the tie-up.

It is worth mentioning that McDonald’s introduced the “Cardi B & Offset Meal” just before Valentine’s Day as a limited-time offer. The meal consisted of several items, including a classic cheeseburger with BBQ sauce, Coca-Cola, and French fries, among others.

“Famous Orders” Campaigns

The company performs all its high-profile collaborations under the “Famous Orders” campaign. After a decade-long gap, McDonald’s joined hands with several artists in the pandemic era. The move turned out to be extremely successful throughout the two years.

The tie-ins included hip-hop artist Travis Scott in September 2020, Colombian reggaeton artist J Balvin in October 2020, pop group BTS in May 2021, and finally American rap star Saweetie in August 2021.

Is MCD a Buy?

McDonald’s value offerings for consumers and efforts to expand its presence with more store openings point at its growth potential. On another positive note, MCD stock has an impressive dividend yield of 2.2%, which also compared favorably with the sector’s average of 0.6%.

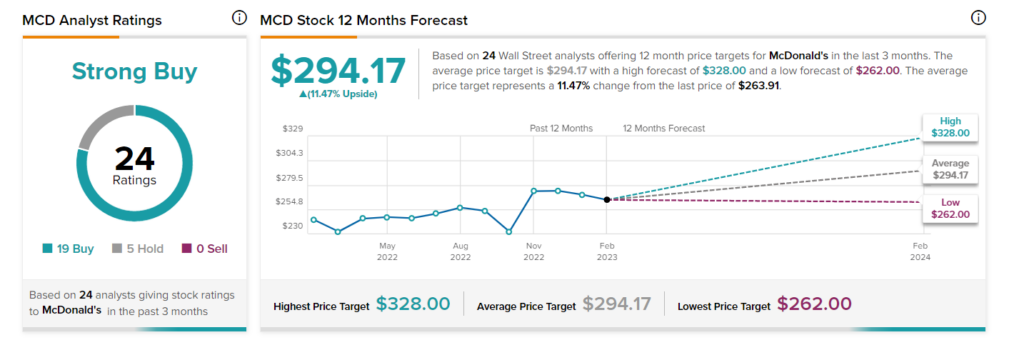

McDonald’s stock is a Moderate Buy on TipRanks. This is based on 19 Buy and five Hold recommendations. Meanwhile, analysts’ price target consensus of $294.17 implies 11.5% upside potential.