Despite the love-hate relationship between the U.S. and China, U.S. companies continue to bet big on the Chinese economy. In the latest move, global restaurant major McDonald’s (NYSE:MCD) plans to nearly double its footprint in the country. The company is slated to report its first-quarter numbers today.

Betting Big on China

The major plans involve McDonald’s nearly doubling its restaurant count in China to over 10,000 by the end of 2028. Notably, coffee beverages giant Starbucks (NASDAQ:SBUX) is also on a similar expansion spree in China.

For McDonald’s, though, the market dynamics in China are a tad different. Chinese consumers are leaning toward domestic names amid a trend of nationalist buying. Additionally, competition from home-grown Chinese names is heating up. According to the Wall Street Journal, one such name is Tastein. The company offers inexpensive burgers that are tailored to local consumers’ tastes. The company’s restaurant interiors showcase the made-in-China slogans, while its offerings are made with ingredients such as peking duck and spicy tofu.

McDonald’s is also tweaking its offerings in China to cater to its customers’ taste buds. Moreover, it is resorting to interesting promotions to attract customers. The move from MCD points to the importance of China, which is its fastest-growing market. Notably, MCD opened over 1,000 new locations in China last year. Meanwhile, other U.S. names such as Apple (NASDAQ:AAPL) and Tesla (NASDAQ:TSLA) have faced sales pressures in China in recent times.

Is McDonald’s Stock a Buy, Sell, or a Hold?

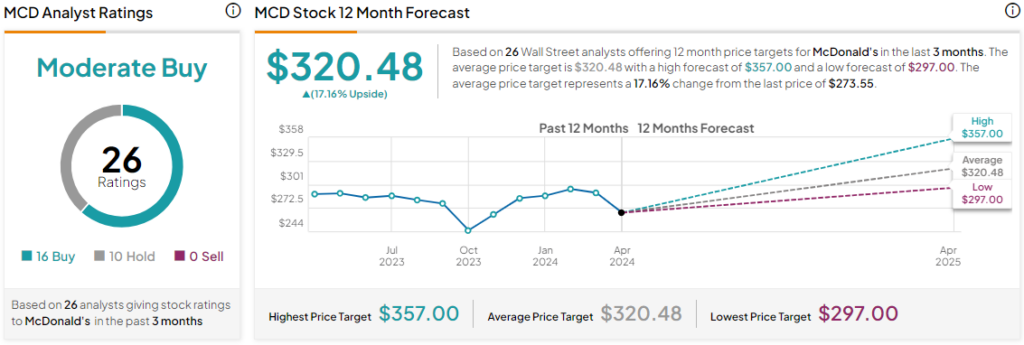

McDonald’s share price has gained by nearly 6% over the past six months. Overall, the Street has a Moderate Buy consensus rating on the stock, alongside an average MCD price target of $320.48. this points to a nearly 17.2% potential upside in the company’s share price.

Read full Disclosure