Fast food chain McDonald’s Corporation (NYSE:MCD) is scheduled to release its first quarter Fiscal 2024 results before the markets open on Tuesday, April 30. McDonald’s operates a chain of franchisees worldwide. Potential risks, including pricing pressures, macroeconomic headwinds, competition, dependence on the franchisee model, and changes to health/dietary patterns, could impact the Q1 performance. In the past year, MCD shares have lost 4.9%.

Baird Analyst Weighs In

Robert W. Baird analyst David Tarantino remains a Buy on MCD stock. However, on April 15, the five-star analyst cut the price target on MCD to $305 (10.7% upside) from $315 to reflect the near-term challenges.

Tarantino is particularly cautious of MCD’s international exposure where the company has already warned of slowing demand. The analyst cited McDonald’s mid-March commentary on demand softness in Europe, impacts from the Middle East war, and a slow start to China.

The Street’s Expectations for MCD’s Q1

The Street expects MCD to post adjusted earnings of $2.72 per share, higher than the prior-year quarter’s figure of $2.63 per share. Furthermore, the consensus for sales is pegged at $6.16 billion, showing a 4.5% year-over-year increase.

McDonald’s has been able to pass on a bit of the elevated input pricing costs to customers. The company’s global comparable sales growth of 9% in FY23 reflects resilience and strong execution. Management attributed MCD’s U.S. comparable sales growth of 4.3% in Q4 2023 to the strong average check growth, backed by menu price increases. Meanwhile, comparable sales growth of 4.4% in the International Operated Markets segment was driven by strength in most markets.

This year, however, analysts are uncertain about the possibility of passing on any more price hikes to customers. Tarantino’s survey on pricing and consumer resistance showed that customers have been pushing back on price actions so far in 2024. Accordingly, the same-store traffic metric will be an important one to gauge McDonald’s performance and value proposition, Tarantino added.

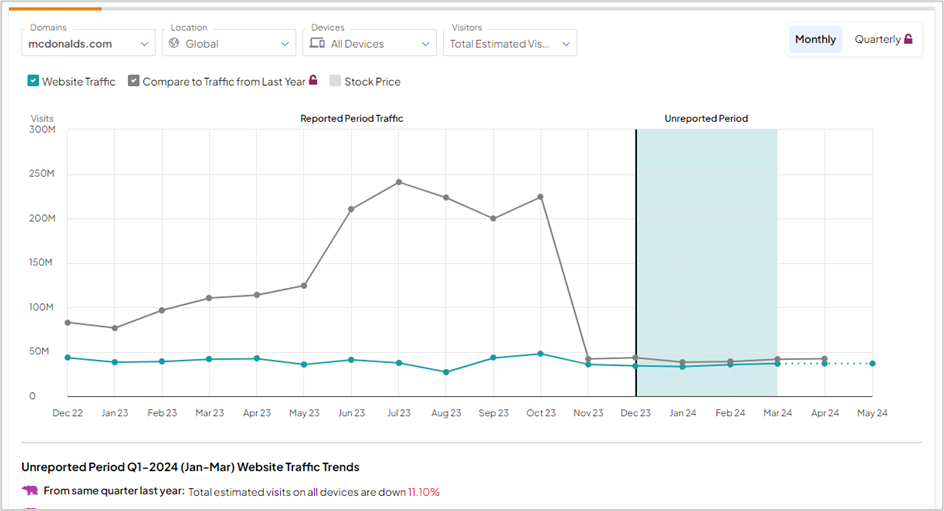

Website Traffic Trends Point to Declining Growth

Investors can use TipRanks’ Website Traffic Tool to gain insights into a company’s upcoming earnings report. The tool offers information on how a company’s website domain performed over a specific time frame.

According to the tool, total visits to mcdonalds.com declined in all three months of the March quarter (overall visits down 11.1% in Q1), compared to the prior-year quarter. Given the consistent drop in the past quarter, it would be reasonable to assume that McDonald’s Q1 could reflect ongoing macro pressures.

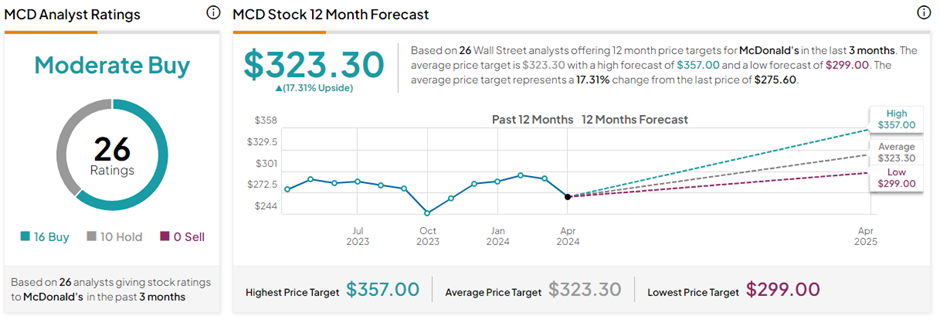

Is McDonald’s Stock a Buy or Sell?

Owing to the pricing pressure and near-term headwinds, analysts remain split on MCD’s stock trajectory. On TipRanks, MCD has a Moderate Buy consensus rating based on 16 Buys and 10 Hold ratings. The average McDonald’s price target of $323.30 implies 17.3% upside potential from current levels.

Moreover, MCD stock pays a regular quarterly dividend of $1.67 per share, reflecting an above-average yield of 2.39%.

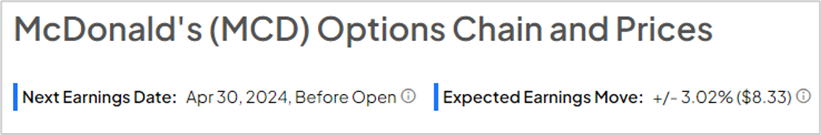

Insights from Options Trading Activity

It’s worth noting that options traders are pricing in a +/- 3.02% move on earnings, mostly in line with the previous quarter’s earnings-related move of -3.73%.

The expected move is determined by computing the at-the-money straddle of the options closest to the expiration after the earnings announcement.

Learn more about TipRanks’ Options tool here.

Ending Thoughts

Interestingly, McDonald’s has outpaced analysts’ estimates in the past eight quarters. That said, the Street’s consensus shows modest earnings growth over the prior-year period, reflecting the possible impact of near-term pressures on the burger food chain.