Barbie maker Mattel (NASDAQ:MAT) delivered lower-than-expected Q4 results as the global toy industry navigates challenges due to soft demand. Despite the challenges, the company expects its earnings to grow in 2024. Mattel expects its adjusted EPS to be between $1.35 and $1.45 in 2024, up from $1.23 in 2023. Moreover, it compares favorably with the analysts’ estimate of $1.37.

Notably, the company’s bottom line will likely get a significant boost from its cost savings program. In 2023, it generated cost reductions of $132 million. Further, it announced a new margin expansion program targeting an additional $200 million of annualized savings between 2024 and 2026.

Mattel’s Board of Directors has approved a new $1 billion share repurchase program, thanks to improving margins and EPS growth.

Mattel’s Q4 Performance

Mattel delivered net sales of $1.62 million, up 16% year-over-year. However, it fell short of analysts’ expectations of $1.65 billion. Nonetheless, the company highlighted that consumer demand for its products was better than the industry average.

Mattel delivered adjusted earnings of $0.29 per share, reflecting a significant improvement from $0.18 in the prior-year quarter. However, its EPS missed the Street’s estimate of $0.31.

What is the Forecast for Mattel Stock?

Mattel has made significant progress in scaling its portfolio, growing franchise brands, and advancing the e-commerce and D2C (Direct-to-Consumer) platforms. Moreover, it is strengthening its relationships with major entertainment partners and retailers. Additionally, the company is reducing costs, which will likely boost its margins and EPS.

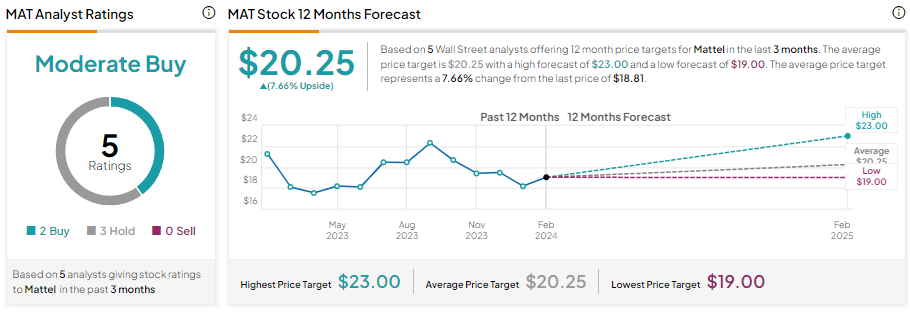

However, the challenging industry background keeps analysts cautiously optimistic about its prospects. With two Buy and three Hold recommendations, Mattel stock has a Moderate Buy consensus rating.

Mattel stock fell over 8% in one year. Meanwhile, analysts’ average price target of $20.25 implies a limited upside potential of 7.66% over the next 12 months.