For a little while there, things were looking up for Mastercard (NYSE:MA). It rolled out its second quarter earnings report and things were looking bright. Wins in earnings, wins in revenue, and wins in growth all suggested good news to follow. However, Mastercard then attempted to snatch defeat from the jaws of victory with new rules about marijuana, and that sent the credit card provider down somewhat in Thursday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Mastercard’s earnings numbers were solid, if somewhat unremarkable. It posted earnings of $2.89 per share, which was ahead of the $2.83 per share analysts were expecting. Revenue, meanwhile, came in at $6.3 billion, another win against the $6.17 billion analysts called for. It was also a win against its own history, as Mastercard posted 14% greater revenue than it did in last year’s second quarter. Even its cross-border transactions were up, growing fully 24% with a local currency basis.

That should have set up Mastercard for a modest win in share prices, but that’s when Mastercard shot itself squarely in the foot. Mastercard took to a range of U.S. financial institutions, demanding that said institutions block any transactions for marijuana or related products on its debit cards. The unfortunate part is that Mastercard’s reasoning is sound. While numerous state governments have decriminalized or even legalized marijuana, the federal government prohibition remains, which was most of Mastercard’s reasoning to demand an end to pot and pot-related purchases over its network.

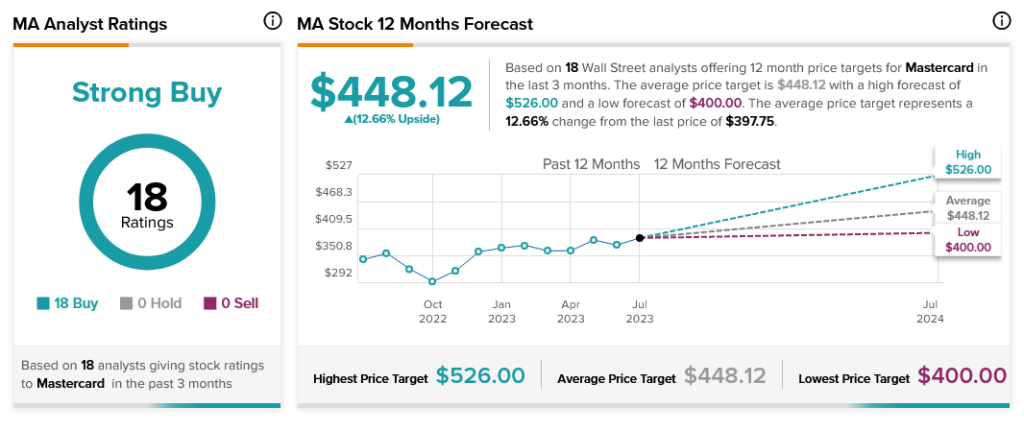

Despite this, Mastercard is still a force to be reckoned with. A whopping 18 Buy recommendations make Mastercard stock, unanimously, a Strong Buy. Further, Mastercard stock offers its investors a 12.66% upside potential thanks to its average price target of $448.12 per share.