Even if inflation is sticky, so are the credit card spending trends that indicate the public’s willingness to consume irrespective of economic conditions. Even as interest rates rise and credit card balances balloon, Americans haven’t stopped shopping and spending – and there are, I believe, ways for stock investors to capitalize on this.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

There’s evidence that U.S. consumers continue to use their credit cards in 2023, though perhaps not as much as they did last year. According to Wells Fargo (NYSE:WFC) CEO Charlie Scharf, “Credit card spending remains strong, but the rate of growth has slowed from the outsized growth rates we saw for 2022.” Furthermore, CFO Mike Santomassimo reported that credit card spending at Wells Fargo increased 13% year over year.

Other banking sector insiders seem to concur with this bullish assessment. Citigroup (NYSE:C) CEO Jane Fraser sees “the U.S. consumer as resilient,” while JPMorgan Chase (NYSE:JPM) CEO Jamie Dimon assures, “The consumer is in good shape. They’re spending down their excess cash.” With that in mind, let’s take a closer look at two credit card issuers that are reporting earnings. Hopefully, they will confirm the widespread optimism about American shoppers in 2023.

Visa (NYSE:V)

Visa is scheduled to report its fiscal third-quarter earnings results today after the market closes. The company’s track record of beating Wall Street’s quarterly EPS estimates is quite impressive. Will Visa pull off another win this time?

It’s entirely possible, as analysts are calling for Visa to report EPS of $2.12, which would represent a moderate improvement over the year-earlier quarter’s EPS of $1.98. Also, Wall Street expects Visa to report quarterly revenue of $8.06 billion, which would continue the company’s pattern of revenue increases.

Maybe, an earnings beat would send Visa stock above the stubborn $245 resistance level. Barclays (NYSE:BCS) analyst Ramsey El Assal seems optimistic about Visa over the next 12 months, as he maintains a Buy rating on the shares and raised his price target on V stock from $272 to $287. Now, let’s see how the analyst community generally feels about Visa.

What is the Price Target for Visa Stock?

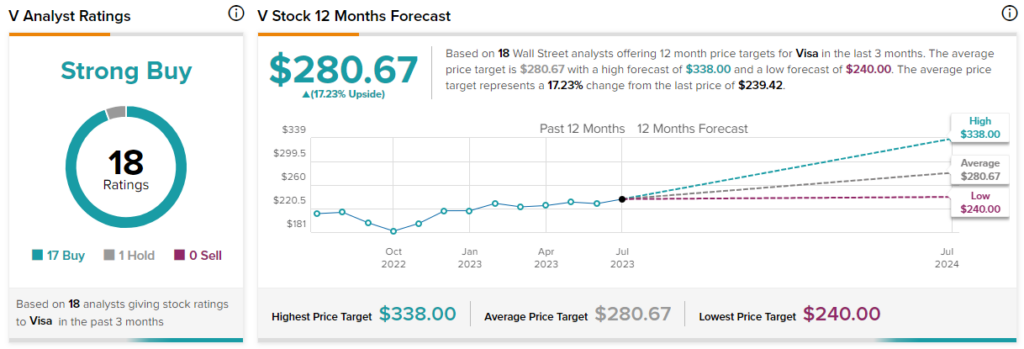

According to TipRanks’ analyst rating consensus, V is a Strong Buy based on 18 Buys and one Hold rating. The average Visa stock price target is $280.67, implying 17.2% upside potential.

Mastercard (NYSE:MA)

Speaking of analysts’ ratings, El Assal also recently reiterated his Buy rating on Mastercard stock while raising his target price on MA from $437 to $470. The stock is only slightly above the $400 level now, so El Assal is evidently bullish as Mastercard gets ready to release its second-quarter 2023 financial results on the morning of July 27.

Like Visa, Mastercard has an excellent track record when it comes to beating analysts’ quarterly EPS forecasts. For Q2, Wall Street expects Mastercard to report EPS of $2.83 compared to $2.56 in the year-earlier quarter.

That’s not an impossible bar to clear for credit card giant Mastercard, especially if the consumer is as resilient as some experts claim. As we’ll see in a moment, the experts on Wall Street have high hopes for Mastercard despite persistent inflation.

For instance, Bank of America (NYSE:BAC) analyst Jason Kupferberg recently reaffirmed a Buy rating on MA stock and lifted his price target on the shares from $438 to $442 — not as ambitious as El Assal, but optimistic nonetheless.

What is the Price Target for Mastercard Stock?

On TipRanks, MA is a Strong Buy based on 19 unanimous Buy ratings assigned by analysts in the past three months. The average Mastercard stock price target is $448.05, implying 11.4% upside potential.

Conclusion: Should You Consider These Credit Card Stocks?

Ultimately, betting on credit card stocks like V and MA is a vote of confidence in the U.S. consumer and economy. Still, you don’t have to be a super-patriot to own these stocks.

Soon, we’ll see whether the consumer is, indeed, strong enough to carry Visa and Mastercard to another round of earnings beats. Personally, I’m feeling confident and would highly recommend considering these stocks before or after the quarterly results are released.