It just wasn’t credit card giant Mastercard’s (NYSE:MA) day today, as it slipped fractionally in Monday morning’s trading session. It brought in a new vice-chairman and announced some new expansion plans, but investors just weren’t feeling the love.

Mastercard looked to the former governor of Utah and U.S. Ambassador John Huntsman to take over as its vice-chairman and president of strategic growth. Huntsman, a former ambassador to Russia, China, and Singapore, will be tasked with building commercial partnerships for public sector operations, including governments.

Huntsman will also help build Mastercard’s sustainability, inclusive growth, and philanthropy operations. Tapping a former public sector figure like Huntsman may seem odd for building a credit card business, but since Mastercard is targeting the public sector here, they’re likely counting on his wealth of experience in the field.

Mastercard Welcomes Partnership with Nexi

Mastercard recently welcomed a new partnership between itself and Nexi in Europe as it works to drive e-commerce operations therein. The combined effort of Mastercard and Nexi, reports note, will ultimately produce an “integrated digital payment ecosystem,” giving consumers more options in the field.

Naturally, that will mean more payments for Mastercard to process, adding to its bottom line. It’s also likely to serve as good news for the banking sector, which will have better access to financial application programming interfaces (APIs). That, in turn, will allow for more rapid development of tools that customers want to use and potentially offset the inherent problems of rising delinquency rates.

Is Mastercard a Buy, Sell, or Hold?

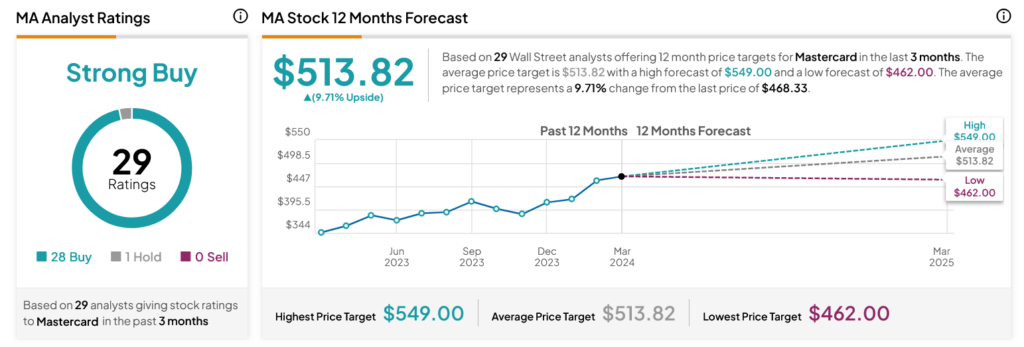

Turning to Wall Street, analysts have a Strong Buy consensus rating on MA stock based on 28 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 36.54% rally in its share price over the past year, the average MA price target of $513.82 per share implies 9.71% upside potential.