Gambling on sports is nothing new. Even in states where it was illegal—and that’s been the case for quite some time—the informal office pool was a long-standing institution. Yet, with more states bowing to the inevitable (not to mention getting a piece through taxes), more and more sports gamblers are stepping up. March Madness, for example, is expected to bring in over 68 million Americans.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

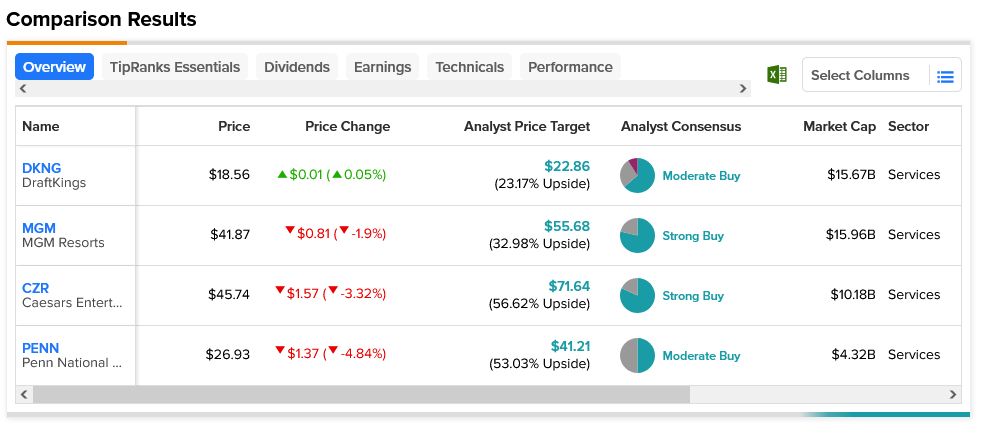

Incoming bettors will have no shortage of potential platforms on which to bet. DraftKings (NASDAQ:DKNG), MGM Resorts (NYSE:MGM), Caesars Entertainment (NASDAQ:CZR), and Penn National Gaming (NASDAQ:PENN) are just some of the companies that gamers can turn to. Reports suggest that gamblers won’t be chintzy, either, distressing macroeconomic conditions aside. Americans alone mean to shell out a combined $15.5 billion on the tournament, and that’s up just over five-fold from the 2022 total of $3.1 billion.

Of course, that whole figure won’t be going directly to newly-available options. Around 21 million are planning to simply make bets with friends, backed up by little more than a handshake. Meanwhile, 56.3 million are looking forward to that formerly-illegal office pool or similar bracket contest. Still, a substantial 31 million will be turning to platforms, bookies, or retail sportsbooks to place their bets. Such a move will likely give casino stocks a bit of an edge, at least for a while, particularly when earnings season comes around and the final counts are in.

As for the four platforms referenced today, they’re in a range of conditions. Two are considered Strong Buys by analyst consensus: MGM Resorts and Caesars Entertainment. DraftKings and Penn National are merely Moderate Buys. DraftKings has the lowest upside potential of the four; its $22.86 price target gives it 23.17% upside potential. Meanwhile, Caesars’ $71.64 average price target gives it 56.62% upside potential.