The largest U.S. banks will start to report their second-quarter results later this week and they are expected to record the biggest jump in loan losses since the pandemic. The rise in loan losses reflects the impact of increased interest rates and high inflation on borrowers.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Big Banks to Report Huge Q2 Loan Losses

Higher interest rates helped in boosting the net interest income (NII) of banks over recent quarters. However, the persistent rise in interest rates and the fading of pandemic-era stimulus and other government benefits have started impacting borrowers, triggering higher loan losses and a rise in provisions for potential bad debts.

As per a Financial Times report, which cited Bloomberg estimates, JPMorgan Chase (NYSE:JPM), Bank of America (NYSE:BAC), Citigroup (NYSE:C), Wells Fargo (NYSE:WFC), Goldman Sachs (NYSE:GS) and Morgan Stanley (NYSE:MS) are estimated to have written off a total amount of $5 billion due to defaulted loans in Q2 2023.

Moreover, these six big banks are expected to set aside an additional $7.6 billion to cover potential bad loans. Both these estimates are about double compared to the prior-year quarter. However, the report notes that the two estimates are still below the levels observed at the beginning of the COVID-19 pandemic, when charge-offs and provisions were at $6 billion and $35 billion, respectively.

It is worth noting that losses related to credit cards are expected to be a sore area for several banks. In particular, JPMorgan’s Q2 credit card loan charge-offs are estimated to come in at $1.1 billion compared to $600 million in the comparable quarter of the prior year. Meanwhile, credit card charge-offs at Bank of America are expected to account for about 25% of the overall charge-offs.

Banks are also expected to be impacted by the weakness in their commercial real estate (CRE) loan portfolio, as demand for office space has declined due to remote and hybrid work styles. Earlier this month, Wells Fargo, the biggest CRE lender, cautioned that it kept aside an additional $1 billion to cover potential loan losses associated with office buildings and other poor-performing real estate.

Further, the slump in investment banking revenue is also expected to persist in Q2, as macro pressures continue to hit dealmaking activity. Additionally, trading revenues are expected to be weak.

NII Expected to Be Strong

Analysts expect the bottom lines of leading U.S. banks to gain from higher NII due to higher interest rates, which could likely offset the negatives discussed above.

Also, the regional banking crisis is expected to have benefited the larger banks due to the shift of deposits from smaller players.

This week, JPMorgan, Citigroup, and Wells Fargo are expected to kick off bank earnings. Analysts expect JPM and Wells Fargo’s Q2 EPS to rise 43% and 58% year-over-year, respectively, while Citigroup’s EPS is projected to decline over 38%.

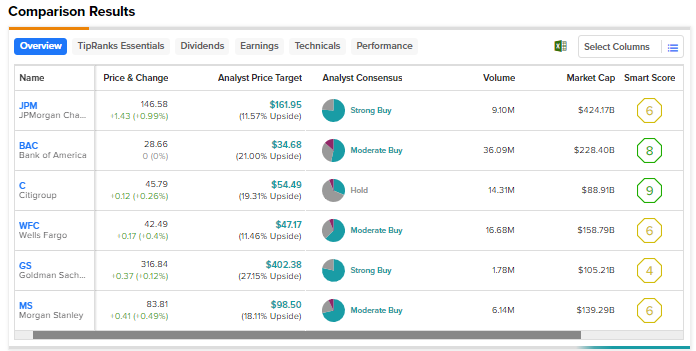

As seen in the consolidated table below, created using TipRanks’ Stock Comparison Tool, ahead of the Q2 results, Wall Street has a Strong Buy consensus rating on JPMorgan and Goldman Sachs.