Today was not a great day for cruise stocks, despite some signs that the cruise industry is still in the midst of a comeback following the disaster that was basically 2020 to 2022 or so. Three major cruise lines–Carnival (NYSE:CCL), Royal Caribbean (NYSE:RCL), and Norwegian (NYSE:NCLH)–were all down in Wednesday afternoon’s trading. So, what happened? Well, Norwegian came out with its earnings report, which wasn’t exactly bad, but not great, either.

It beat the earnings projections but missed revenue projections, a somewhat dangerous combination that suggests that cost-cutting was involved somewhere. Cost-cutting is great in isolation, but it’s not really sustainable on its own. And it didn’t help matters much when Norwegian also offered up second-quarter guidance, which looks for worse results even as its bookings are at record levels.

Stranded Cruisers, No Kids Allowed

This isn’t great news for Norwegian customers as it is, but it doesn’t get better from there. You might remember the story of eight Norwegian Cruise Line passengers who missed their boat in Africa, which departed when an elderly couple couldn’t reach the ship before its debarkation time and left passengers behind. Well, the group sought to rejoin the ship when it reached Spain but, apparently, managed to miss the boat on that connection as well, noted a report from CTV News.

Meanwhile, the founder of the recently-IPOed cruise line Viking, Torstein Hagen, revealed the secret to making a cruise line a big deal: focus on the super-rich and don’t let any kids on board. That focus on well-heeled big spenders with no kids apparently gave Viking quite the edge, as reports note it traded over 10% of its IPO price today alone.

Which Cruise Stocks Are a Good Buy Right Now?

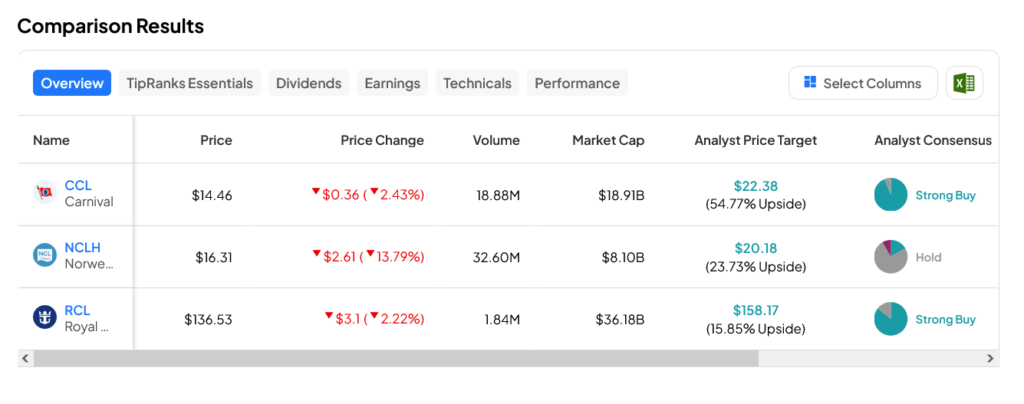

Turning to Wall Street, the leader in the sector right now is CCL stock. This Strong Buy stock offers investors a 54.77% upside potential against an average price target of $22.38 per share. Meanwhile, fellow Strong Buy RCL stock is the laggard, as its $158.17 average stock price allows for only a 15.85% upside potential.