Shares of Maison Solutions (NASDAQ:MSS), a multi-channel grocery retailer focusing on Asian communities, closed 124% higher on its stock market debut yesterday. This remarkable performance surpassed the listings of CAVA (NYSE:CAVA), ODDITY (NASDAQ:ODD), and Arm Holdings (NASDAQ:ARM), which marked first-day trading gains of 99%, 35%, and 25%, respectively.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Factors Impacting MSS Stock

Maison Solutions, which operates through brick-and-mortar stores as well as online, delivered net revenues of approximately $13.8 million for the three months ended July 31, 2023. This equates to a year-over-year gain of 20.5%. At first glance, the growth in revenue looks strong, considering the macro headwinds. However, the company is facing multiple headwinds.

In its latest quarterly SEC filing, the company revealed that it is grappling with heightened competition from two newly opened Asian supermarkets, which is hurting its sales. Further, its top line is also taking a hit as more people are dining out rather than purchasing pre-made meals from grocery stores and preparing meals at home. Additionally, the company has observed reduced online sales as customers return to their pre-pandemic shopping behaviors with the waning impact of COVID-19.

All of these have raised concerns about whether the MSS stock can maintain its upward trajectory or whether it will relinquish all of its gains driven by its IPO, similar to what happened with ARM, CAVA, and ODD stocks.

With this backdrop, let’s look at the performance of CAVA, ODDITY, and Arm Holdings stock.

Here’s How CAVA, OOD, and ARM Stocks Performed

Shares of the Mediterranean restaurant chain Cava spiked 99% higher in their stock market debut. However, the graph below shows that it gave up all of its gains and is trading in the red.

Meanwhile, shares of ODDITY and Arm Holdings, which gained 35% and 25% on their listings, have also eroded shareholders’ wealth. Concerns around valuation, moderation in growth, and macro uncertainty are to blame for this decline. Let’s look at what the Street recommends for these stocks.

Is ODDITY Stock a Buy or Sell?

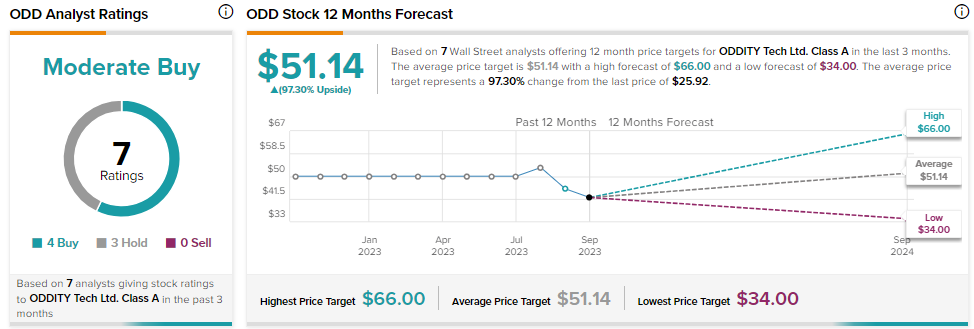

Analysts are cautiously optimistic about ODDITY stock as its growth rate moderates. It has received four Buy and three Hold recommendations for a Moderate Buy consensus rating.

Meanwhile, as the stock has given up its IPO-led gains, analysts’ 12-month average price target of $51.14 implies 97.30% upside potential from current levels.

What is the Price Target for ARM?

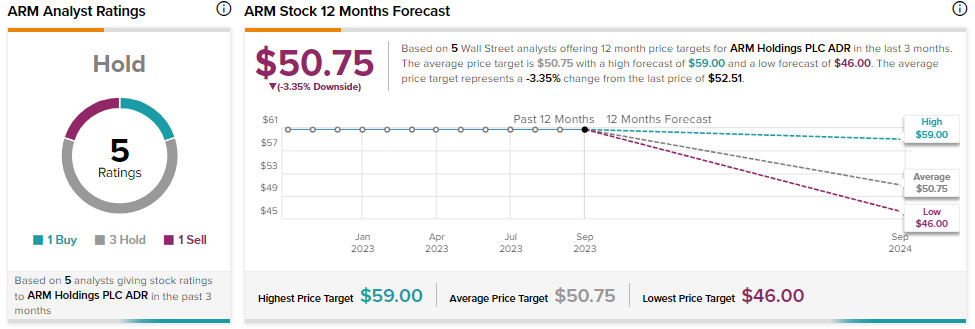

Valuation concerns keep analysts sidelined on Arm Holdings stock. It has one Buy, three Hold, and one Sell recommendation for a Hold consensus rating. Moreover, analysts’ average price target of $50.75 implies 3.35% downside potential from current levels.

What is the Future of CAVA Stock?

Wall Street analysts are cautiously optimistic about CAVA stock. With six Buys and three Holds, CAVA has a Moderate Buy consensus rating on TipRanks. However, given the recent pullback, analysts’ average price target of $48.13 implies 57.13% upside potential.