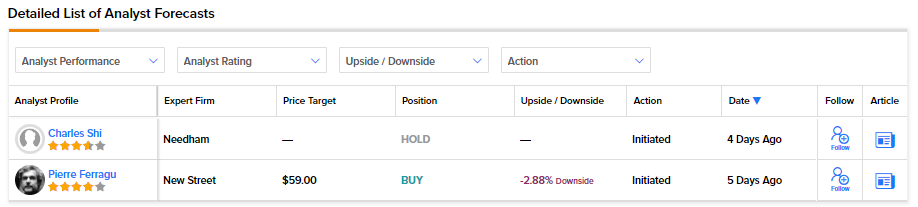

Chip designer Arm Holdings (NASDAQ:ARM) had a solid market debut, closing about 25% higher. However, Needham analyst Charles Shi initiated coverage on the stock with a Hold recommendation and believes its “valuation is full” and positives are already priced in.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Arm Holdings is a leader in the mobile space, as its architecture is the foundation for smartphones. However, the analyst believes that the semiconductor market has grown past the smartphone era, and the next growth phase will depend upon high-performance computing and IoT (Internet of Things), where Arm could find it difficult to compete with other players.

In a note to investors dated September 14, Shi acknowledged that Arm has been diversifying its revenue base and focusing on cloud computing, automotive, and IoT. While the company has managed to push volumes with its IoT applications, the revenue contribution from the segment remains low. On the high-performance computing side, the analyst added that the company would face challenges from Nvidia (NASDAQ:NVDA), Intel (NASDAQ:INTC), and Advanced Micro Devices (NASDAQ:AMD).

However, all is not gloom and doom for Arm as it could continue to derive growth through the smartphone market.

Is ARM Stock a Good Buy?

Arm stock recently started trading on the exchange, which is why it does not have enough analyst coverage. While Shi remains sidelined on Arm stock, New Street analyst Pierre Ferragu is bullish. The analyst assigned a Buy recommendation on Arm stock on September 13. However, Arm stock has already surpassed his price target of $59.

Bottom Line

As the semiconductor market is moving toward AI, Arm’s management remains confident that its CPUs (Central Processing Units) will play a key role in this transition. The company is also working with leading companies like Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) and Nvidia to deploy its technology to run AI workloads. Further, the company expects its total addressable market to grow at a CAGR of 6.8% through 2025, driving its royalty revenues.

However, the company could face challenges expanding into IoT and high-performance computing space. Moreover, its higher dependency on China and a handful of customers could limit the upside potential.