Several factors are coming together against clothier Lululemon (NASDAQ:LULU) at once, and they’re not having a particularly good impact on its projections overall. In fact, a recent analyst downgrade coupled with a growing concern about the overall economy is prompting caution, and investors are pulling back, sending Lululemon down fractionally in Tuesday afternoon’s trading.

The trouble for Lululemon started when Raymond James analysts damned Lululemon with faint praise, cutting its rating from Strong Buy to Outperform but also hiking the price target from $440 to $495. Raymond James analysts looked for Lululemon to deliver results that were about what analysts expected, so there is little chance of a surprise beat here.

This means that revenue should be higher; third-quarter 2023 results should come in 17% higher than third-quarter 2022, thanks to improved performance in Asia, among other things. However, starting in the fourth quarter, that pattern should turn around, and Lululemon’s growth will likely decline.

Wells Fargo Analysts Also Dropped Lululemon

But that’s not all; Wells Fargo analysts also dropped Lululemon, as analyst Ike Boruchow pulled back on Lululemon and instead brought in Nike (NYSE:NKE) as its new “top defensive pick.” Here, Lululemon is simply a victim of its own success and no longer has “…any easy P&L lines to play with…” Furthermore, Lululemon’s valuation has been on the rise ever since its salad days, so there’s likely to be a turnaround as the low-hanging fruit has been swept up and the valuation drops back to more realistic levels.

Is Lululemon Stock a Buy or Sell?

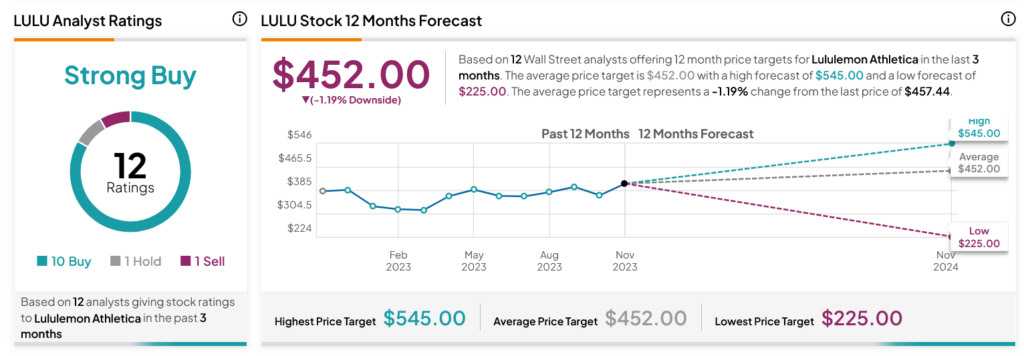

Turning to Wall Street, analysts have a Strong Buy consensus rating on LULU stock based on 10 Buys, one Hold, and one Sell assigned in the past three months, as indicated by the graphic below. After a 23.46% rally in its share price over the past year, the average LULU price target of $452 per share implies 1.19% downside risk.