Shares in timber and real estate group Rayonier (RYN) tumbled nearly 6% today after buying peer PotlatchDeltic (PCH). in an all-stock deal valued at about $3.4 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Wooden Wonder

The deal will create one of the largest publicly traded timber and wood products companies in North America. It will have an equity market capitalization of $7.1 billion and a total enterprise value of $8.2 billion, including $1.1 billion of net debt.

Rayonier said the new venture, which will have 4.2 million acres of land across 11 states, will be well-positioned to capitalize on an improving housing market as well as real estate opportunities.

The announcement came on the same day that President Donald Trump’s sweeping tariffs on imported lumber and wood products take effect, with the intention of boosting domestic manufacturing. The biggest blow from the measures will fall on Canada, the top lumber supplier to the US.

Lumber futures prices have suffered this year as high interest rates have squeezed consumers and dampened demand for new homes. That has also hit the Rayonier share price – see above.

Tariff Revival?

However, the industry is confident that the tariffs, as well as the Fed lowering interest rates and an improved housing situation, will help bring prices back up. Eric Cremers, chief executive officer of PotlatchDeltic, said the Rayonier deal will result in “significant strategic and financial benefits beyond what either of us could achieve independently.”

The deal gives Rayonier shareholders 54% of the new entity and its president and chief executive officer, Mark McHugh, will take the same role in the combined business. Cremers will be the executive chairman of the combined company for 24 months after the deal closes, which is expected by the first or second quarter of 2026.

The new company will operate seven wood products manufacturing facilities, including six lumber mills with total capacity of 1.2 billion board feet and one industrial plywood mill. More than three-quarters of its combined timberland assets will be located in the US South.

Is RYN a Good Stock to Buy Now?

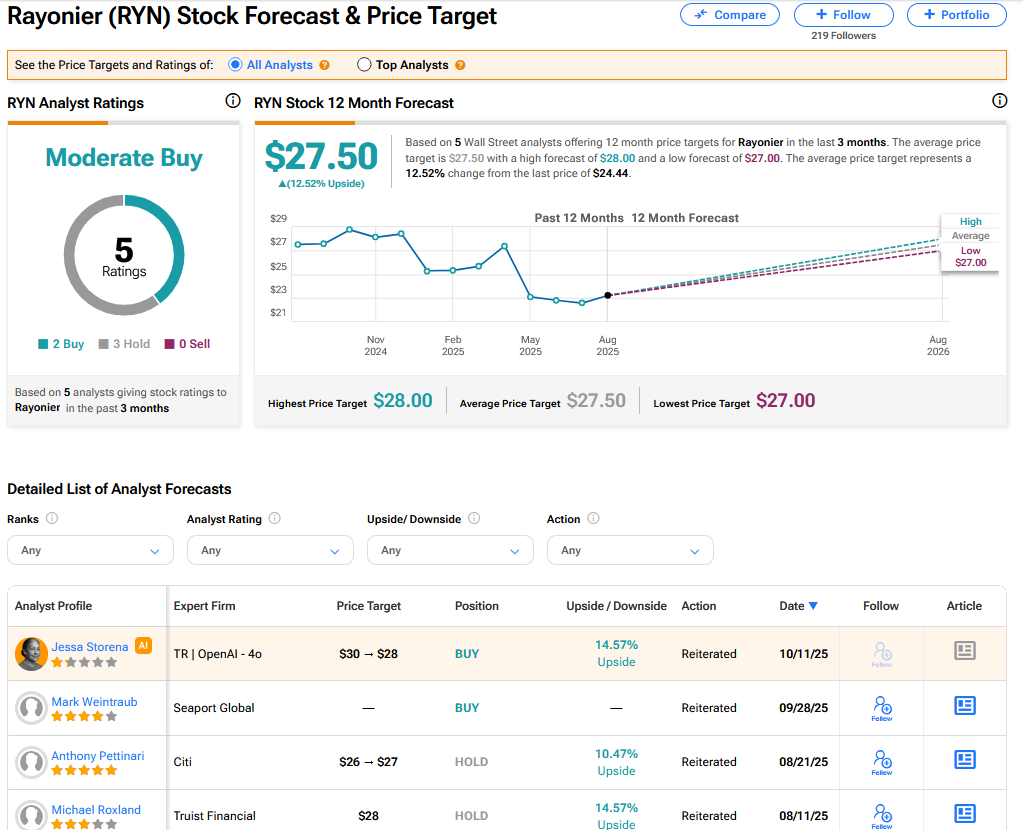

On TipRanks, RYN has a Moderate Buy consensus based on 2 Buy and 3 Hold ratings. Its highest price target is $28. RYN stock’s consensus price target is $27.50, implying a 12.52% upside.