Shares in Protagonist Therapeutics (PTGX) looked heroic today on a report that it could soon be bought by healthcare giant Johnson & Johnson (JNJ).

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Ongoing Talks

Protagonist stock blasted over 30% higher after The Wall Street Journal reported that talks between the two companies were ongoing. Investor interest was so intense that trading in Protagonist shares was temporarily suspended after the report was published.

This is despite the report not disclosing any specific details of the negotiations and given the common proviso that a deal is not guaranteed.

The report suggested that the potential acquisition would strengthen the existing partnership between the two companies.

They are working on a treatment called Icotrokinra as a once-daily treatment for ulcerative colitis (UC).

Earlier this week JNJ produced positive data on the drug from a Phase IIb trial. It triggered clinical remission in 30.2% of patients – dwarfing the 11.1% who experienced this outcome in the placebo group. Clinical remission was characterised by successes such as a lack of rectal bleeding.

Icotrokinra will now advance to a Phase III trial, assessing the efficacy and safety of the peptide in adults and adolescents with moderate-to-severe active UC. It should be completed in 2028.

Strategic JNJ

Johnson & Johnson’s interest in Protagonist would represent another strategic move in the pharmaceutical giant’s ongoing portfolio expansion efforts through acquisitions of promising biotech companies with complementary therapeutic pipelines.

Earlier this year it shelled out a massive $14.6 billion to buy Intra-Cellular Therapies. The transaction brought Caplyta, a breakthrough treatment for schizophrenia and bipolar depression, onto the company’s product portfolio. With a product patent in place until 2040, the company estimates peak sales for the product above $6 billion.

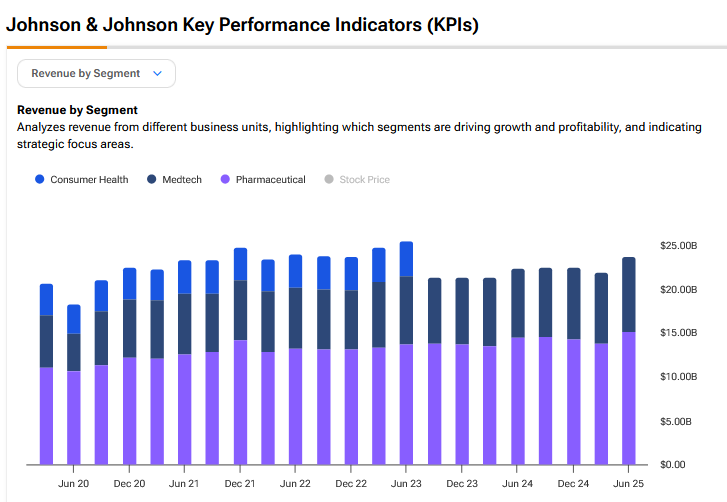

JNJ will hope that the acquisition of Protagonist – if any deal is made – will give its revenues from pharmaceuticals a further boost – see above.

Is JNJ a Good Stock to Buy Now?

On TipRanks, JNJ has a Moderate Buy consensus based on 12 Buy and 7 Hold ratings. Its highest price target is $213. JNJ stock’s consensus price target is $195.18, implying a 2.05% upside.