One of the first big slices of merger and acquisition news for 2024 started off with a bang and ended largely with a whimper. The planned merger between two electric utility firms—Avangrid (NYSE:AGR) and PNM Resources (NYSE:PNM)—was shut down today thanks to a regulation issue. Avangrid gained over 3.5% in Tuesday afternoon’s trading, while PNM Resources fell nearly 6%.

The issue seems to mainly trace back to Avangrid, who tried to get a string of regulators’ approvals in place by December 31 so that the merger could go through. It got most of them, reports noted, except one approval from the New Mexico Public Regulation Commission. With that one not in hand, the merger was temporarily stymied.

PNM Resources wasn’t exactly willing to call it quits at that point, though, as its own board of directors quickly approved an extension to the merger request. Avangrid, however, turned its back on the whole matter and ultimately terminated the merger. The agreement dates all the way back to October 2020, and had previously been extended until December 31, 2023.

Disaster Caused, or Averted?

Had the merger gone through, noted a report from Axios, the combination of Albuquerque’s own PNM Resources and Avangrid, a division of Spanish company Iberdrola, would have produced the third-largest renewable energy company in the United States. The agreement itself was originally worth $4.3 billion, most of which will likely end up back in Iberdrola’s coffers. When assumed debt is factored in, the value would have ballooned to over $8.5 billion. The problem, meanwhile, wasn’t so much a lack of attentiveness as an outright adversarial stance; New Mexico’s own authorities fought the merger in court from 2021 forward.

Is Avangrid a Better Buy than PNM Resources?

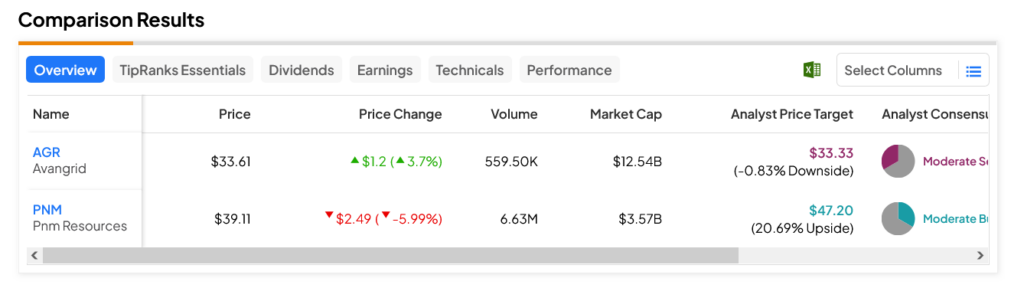

Turning to Wall Street, PNM stock is a Moderate Buy-rated stock with a 20.69% upside potential thanks to its average price target of $47.20. Meanwhile, AGR stock, a Moderate Sell, offers a 0.83% downside risk thanks to its average price target of $33.33 per share.