Shares in food manufacturer Kellanova (K) were looking tastier today on reports that the European Union will give the green light to its $36 billion acquisition by candy giant Mars.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Major Hurdle

According to a Reuters report, Mars will clear a major hurdle in the deal by winning unconditional antitrust approval.

Back in the summer, the prospect of Mars, the maker of Snickers and M&Ms, snapping up the maker of Pringles, Eggo and Rice Krispies was hit as the EU said that the deal could lead to higher prices for consumers due to Mars’ increased negotiating power towards retailers in Europe.

Its preliminary investigation found that adding Kellanova’s brands would increase Mars’ bargaining power with retailers.

“As a result, Mars could be in a position to use this increased leverage to, for example, extract higher prices during negotiations, which in turn would lead to higher prices for consumers,” warned the EC at the time.

It added that several retailers across Europe have also raised concerns about Mars’ increased bargaining power. As a result, retailers said they would be forced to accept higher prices to ensure that these popular products remained on their shelves.

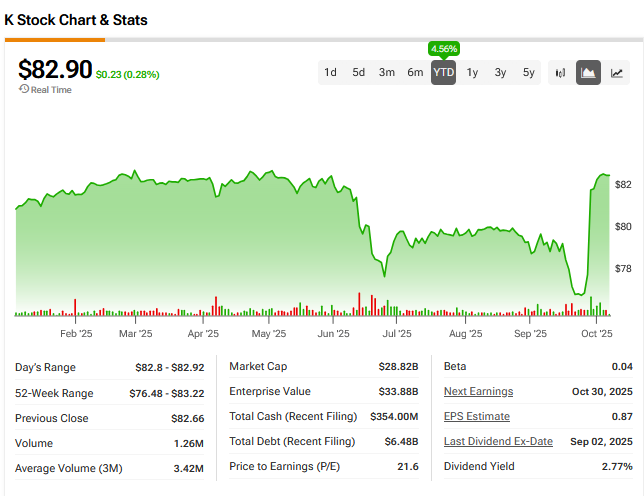

Such concerns over consumer prices and confidence have dogged the Kellanova share price this year – see above – leaving it just 4% higher.

Market Share

However, it appears that the EU has subsequently found insufficient legal grounds to demand concessions. An EU decision on the deal is due by December 19.

It has already secured a green light without any conditions from U.S. authorities.

A combined Mars and Kellanova would account for roughly 12% of the U.S. snacking and candy industry, according to market share data from NielsenIQ.

Mars, which announced the deal last August, hopes it will add to its brand strength and meet demand in fast-growing markets such as Africa and Latin America.

It would be one of the largest-ever deals in the packaged foods industry even surpassing Mars’ acquisition of Wrigley for about $23 billion in 2008.

Is K a Good Stock to Buy Now?

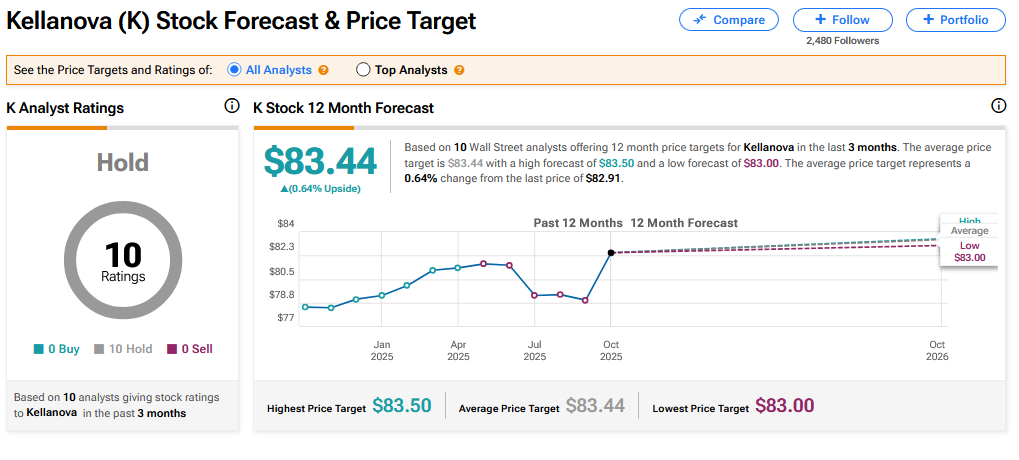

On TipRanks, K has a Hold consensus based on 10 Hold ratings. Its highest price target is $83.50. K stock’s consensus price target is $83.44, implying a 0.64% upside.