The regulatory body of the European Union plans to block Amazon’s (NASDAQ:AMZN) bid to acquire iRobot (NASDAQ:IRBT), the Wall Street Journal reported. In response to the news, IRBT stock slumped about 40% in the after-hours on Thursday. Overall, shares of the iRobot Corporation, which builds consumer robots, have lost over 49% of their value in one year.

The primary reason behind the decline in its share price over the past year has been the apprehension surrounding the regulatory approval of iRobot’s deal with the e-commerce giant Amazon. In addition, soft sales and growing competition took a toll on IRBT stock. Notably, iRobot’s third-quarter 2023 revenue declined 42% in the U.S. and 35% in Japan. Further, it dipped about 1% in the EMEA region.

Analyzing Deal Rejection Factors

According to the report, representatives from Amazon held talks with officials from the European Union Commission regarding a potential acquisition. Nevertheless, Amazon was informed that the proposed deal was likely to be declined.

In November 2023, the European Commission raised concerns about the acquisition, citing potential anti-competitive repercussions. The regulatory body emphasized that Amazon could hinder iRobot’s competitors from utilizing its online platform. Additionally, it noted that Amazon could de-list or diminish the visibility of rival products in its search results.

Meanwhile, in January 2024, Politico reported that Amazon had declined to modify its business structure in Europe to address concerns raised by regulators.

While IRBT stock is under pressure, the stock has two Hold ratings from Wall Street analysts. Meanwhile, let’s look at what the Street recommends for AMZN stock.

Is Amazon a Buy, Hold, or Sell?

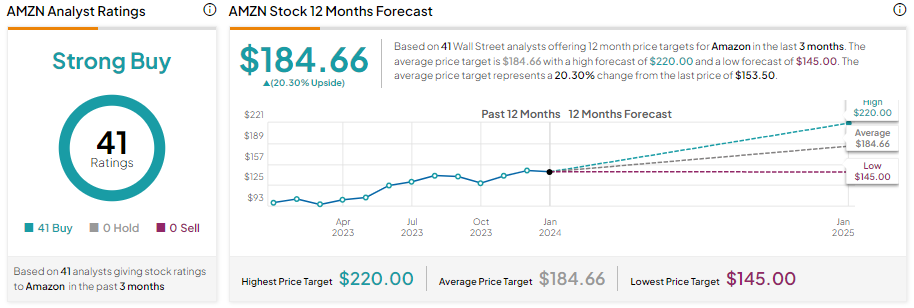

Analysts are bullish about Amazon stock due to its aggressive investments in artificial intelligence (AI) technology and leadership in e-commerce and cloud space. 41 analysts cover AMZN stock, and all recommend a Buy. Amazon stock sports a Strong Buy consensus rating.

Amazon stock has gained nearly 64% in one year. Analysts’ average price target of $184.66 implies it could increase by 20.3% from current levels.