Willscot Mobile Mini Holdings (NASDAQ:WSC), a business services provider offering temporary space solutions, is on the verge of acquiring McGrath RentCorp (NASDAQ:MGRC), a business-to-business rental company. As per a Wall Street Journal report, the deal could value McGrath RentCorp at over $3 billion. MGRC has a market cap of about $2.74 billion.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

According to the report, the cash-and-stock transaction is expected to be announced on January 29. The deal should enhance Willscot Mobile’s capacity to meet the increasing demand for rental units. It’s worth noting that McGrath acquired several smaller companies in 2023, specifically targeting container rental companies in Colorado and South Carolina. This strategic move expanded McGrath RentCorp’s portable storage business, making it an attractive acquisition target.

Lately, Willscot Mobile has been actively pursuing acquisitions, enhancing its portfolio of space solutions through multiple strategic purchases in the past few months. In October 2023, it purchased 616 Global Clearspans (616GC), a premium provider of large clear-span structures. The deal is expected to enhance its ability to provide customers with larger, more flexible spaces.

With this background, let’s look at what the Street recommends for WSC stock.

Is WSC a Good Stock to Buy?

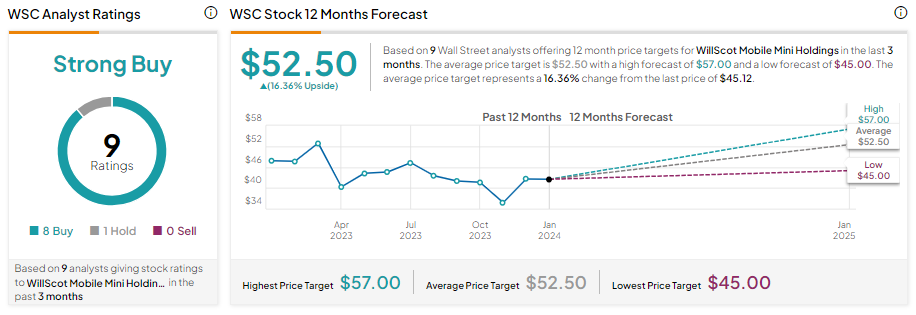

WSC stock fell by about 5% over the past year. However, Wall Street is bullish about its prospects as Willscot Mobile is building capacity and expanding its space solutions business.

WSC stock has a Strong Buy consensus rating based on eight Buy and one Hold recommendations. Analysts’ average price target of $52.5 implies 16.36% upside potential.