The healthcare sector is abuzz with strategic M & A deals. Fresh on the heels of its $14 billion acquisition of Karuna Therapeutics (NASDAQ:KRTX), biopharmaceutical giant Bristol-Myers Squibb (NYSE:BMY) is now set to acquire RayzeBio (NASDAQ:RYZB) for $4.1 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While the KRTX deal aimed to boost BMY’s neuroscience portfolio, the acquisition of RayzeBio promises to bolster its Oncology franchise. RayzeBio is a clinical-stage company with a focus on radiopharmaceutical therapeutics (RPT), which bind to tumor cells and deliver targeted radiation. The company’s product pipeline is targeted at solid tumors, including small-cell lung cancer, hepatocellular carcinoma, and gastroenteropancreatic neuroendocrine tumors.

The $62.50 per share acquisition has received approval from the boards of both companies. The transaction remains subject to closing conditions and is anticipated to close in H1 2024. Recently, BMY announced a global strategic collaboration with SystImmune in a deal worth nearly $8.4 billion. It also expanded its global licensing and research collaboration with Avidity Biosciences (NASDAQ:RNA) in a $2.3 billion deal.

Separately, another healthcare heavyweight, AstraZeneca (NASDAQ:AZN), has announced the acquisition of Gracell Biotechnologies (NASDAQ:GRCL) for $1.2 billion. The move is expected to bolster AZN’s presence in cell therapies.

Is Bristol-Myers Squibb a Good Stock to Buy?

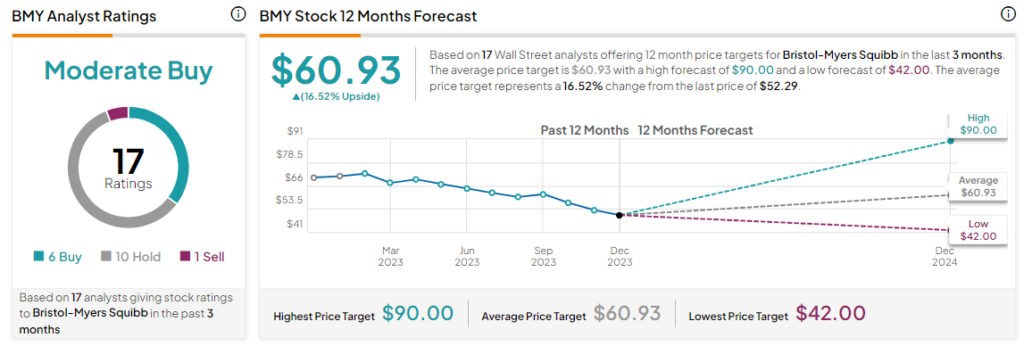

Overall, the Street has a Moderate Buy consensus rating on Bristol-Myers Squibb, and the average BMY price target of $60.93 points to a 16.5% potential upside in the stock. That’s on top of a nearly 8% jump in the company’s share price over the past month. Meanwhile, RYZB shares have nearly doubled in today’s early session.

Read full Disclosure