Healthcare giant AstraZeneca (NASDAQ:AZN) is expanding its cell therapy portfolio with the acquisition of Chinese biopharmaceutical company Gracell Biotechnologies (NASDAQ:GRCL) for $1.2 billion. The announcement of the deal has propelled Gracell shares nearly 60% higher today.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Gracell, a clinical-stage company, is focused on the development of cell therapies for the treatment of cancer and autoimmune diseases. The M & A deal adds GC012F, an autologous BCMA/CD-19 CAR-T therapy, to AstraZeneca’s growing cell therapy pipeline.

In Autologous CAR-T therapy, a subject’s immune T cells are reprogrammed to target disease-causing cells. GC012F can potentially be a new therapy for multiple myeloma and other haematologic malignancies. It may also treat autoimmune diseases such as systemic lupus erythematosus (SLE). Further, Gracell’s technology promises substantially lower manufacturing time.

Under the deal, AZN will acquire all of Graell’s fully diluted share capital at $2 per share ($10 per GRCL ADS). An additional non-tradable contingent value right (CVR) worth $0.30 per share ($1.50 per GRCL ADS) is payable depending on a specified regulatory milestone. The total deal value of $1.2 billion points to a massive 192% premium over Graell’s 60-day VWAP (volume-weighted average price).

The acquisition is anticipated to close in Q1 2024. Upon closure, Gracell will function as a wholly owned subsidiary of AZN with a presence in the U.S. and China.

What is the Target Price for AZN Share?

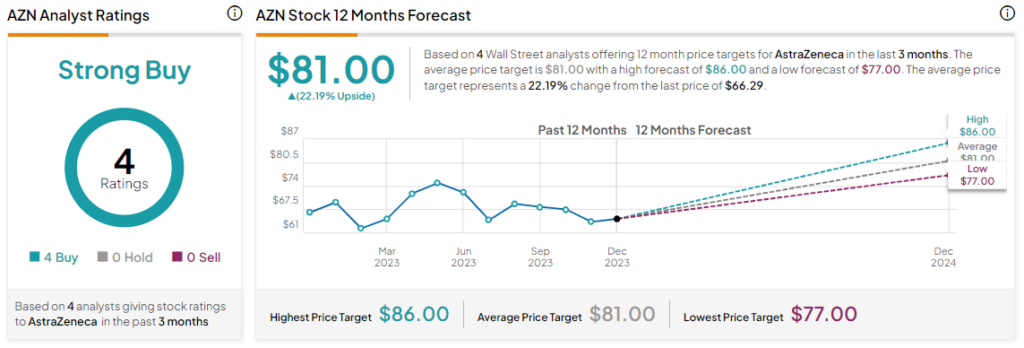

Overall, the Street has a Strong Buy consensus rating on AstraZeneca, and the average AZN price target of $81 implies a substantial 22.2% potential upside in the stock. That’s on top of a nearly 44% gain in AstraZeneca shares over the past three years.

Read full Disclosure