Soccer club Manchester United (NYSE:MANU) has reached an agreement with British billionaire Jim Ratcliffe to sell a 25% stake in the club for $1.3 billion. The deal values the club at $6.3 billion, including debt, and is subject to English Premier League approval.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Investors should note that Ratcliffe is the chairman and founder of the INEOS petrochemical company. Interestingly, he is the owner of the French soccer club Nice and has a stake in the Mercedes-AMG Petronas Formula One team.

Terms of the Deal

As per the agreement, Ratcliffe will acquire 25% of the Class B ordinary shares of the company and 25% of the Class A ordinary shares, both for $33 per share in cash. Furthermore, he will invest $300 million for future investment in the Old Trafford stadium. Of the total amount, $200 million will be provided upon completion of the deal, and a further $100 million by the end of 2024.

Following the closure of the deal, INEOS will be responsible for the club’s football operations, including all aspects of the men’s and women’s teams and academies. Apart from this, INEOS is granted two seats on the Manchester United PLC board and the Manchester United Football Club boards.

Is MANU a Buy or Sell?

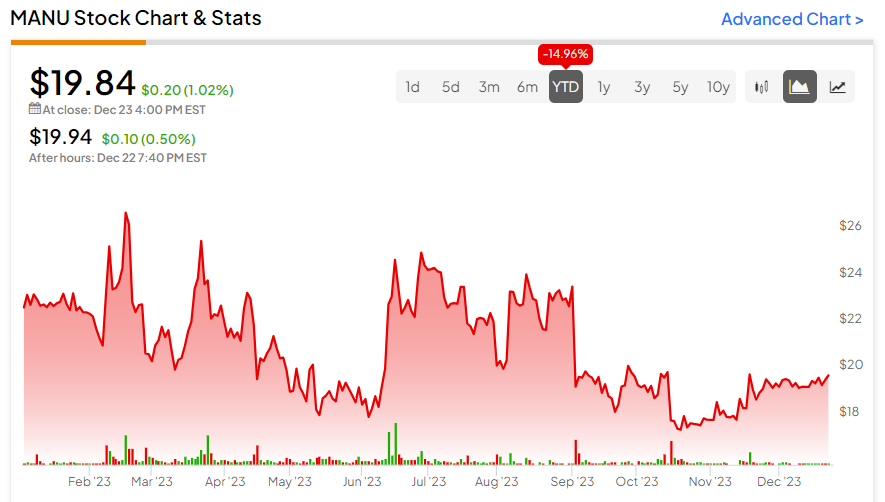

Despite being a renowned soccer club with a long history of success, the company is struggling to become profitable. Also, valuation concerns weigh on the price of MANU. It has underperformed the broader markets and is down about 15% year-to-date. However, a change in management might be able to facilitate the company’s revival.