2023 was a rough year for large luxury e-commerce retailers. During the Q4 earnings call, Michael Mente, the co-CEO of Revolve Group (NYSE:RVLV) noted that two large luxury e-commerce retailers were acquired in distressed buyouts, and another was listed as a discontinued operation by its parent company. The companies that can weather such periods of distress often emerge as stronger players with more market share and room to grow. Next-gen luxury retailer Revolve looks like it fits that mold and could offer a significant long-term opportunity for growth-oriented investors looking for exposure to the luxury online space.

While it has been challenged during the past six quarters, the most recent financial results provide a few green shoots, suggesting it is turning the corner to brighter days.

Hip Threads for the Next-Gen

Revolve is an online-only fashion retailer that targets Millennial and Gen Z customers and offers an array of apparel, footwear, and beauty products from a curated selection of emerging, established, and owned brands. The company’s commitment to providing free, two-day shipping and free returns distinguishes it from its competitors in the market.

The company has carefully cultivated a brand image that resonates with the highly sought-after demographic of fashion-forward Millennials and Gen Z consumers. The REVOLVE Festival, now in its seventh year, has reached iconic status thanks to the blend of fashion, music, and celebrity, as has the group’s limited-time pop-up shops in places like Aspen, Colorado.

Revolve is well-positioned to take advantage of the consolidating/collapsing luxury e-commerce space. The company’s recent results reflected an improvement in some metrics, indicating the possibility of better times ahead.

Is Revolve Profitable?

Revolve recently presented its Q4 financial results, revealing an earnings per share (EPS) of $0.05, surpassing the consensus estimate of $0.03. Net sales came in at $257.8 million, also beating consensus expectations for $246.2 million, a decrease of 1% year-over-year but a sequential improvement from the 4% decrease in Q3. Despite these challenges, there was notable growth in the active customer base. The customer count increased by 33,000 in Q4, reaching 2,543,000 active customers at the close of 2023 – a 9% increase year-over-year.

The company finished the year with total net sales of $1.1 billion, reflecting a 3% year-over-year decrease. Moreover, diluted EPS declined 52% to $0.38.

Despite the challenging environment, Revolve closed the year with a significant increase in operating and free cash flow at $43 million and $39 million, respectively. The strong cash flow and no reported debt reinforce the company’s sturdy financial standing.

Is RVLV a Good Stock to Buy?

RVLV stock has been trending up, climbing over 24% year-to-date. It currently sits in the middle of its 52-week price range of $12.25-$26.76 and demonstrates ongoing positive price momentum, trading above its 20-day (19.87) and 50-day (18.03) moving averages.

It looks to be somewhat richly valued relative to its peers, with a P/E of 53.89x vs. the Consumer Cyclical sector average of 18.35x and the Internet Retail industry average of 34.6x.

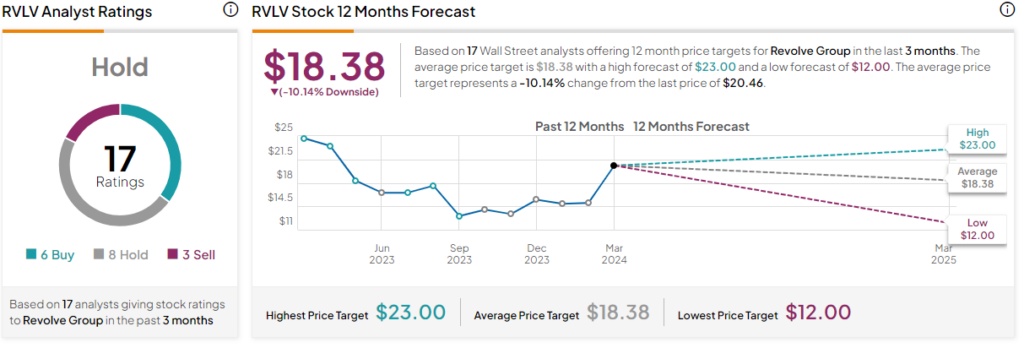

Meanwhile, analysts following the company are leaning towards caution on the stock, with a Hold consensus rating based on six Buy, eight Hold, and three Sell recommendations. The average price target for RVLV is $18.38, which represents a 10.14% downside from current levels.

RVLV in Summary

2023 was a trial by fire for the luxury e-commerce sector, with several notable players succumbing to the pressures of the market. However, throughout this turmoil, the Revolve Group has been demonstrating a clear potential for growth.

While RVLV stock is not cheap at these levels, it does appear to reflect some of the expectations of upward potential for the company. Much like the luxury goods the company sells…you get what you pay for, a reasonable proposition for investors looking for long-term growth potential in this space.