Athletic and lifestyle apparel retailer Lululemon Athletica (NASDAQ:LULU) reported fourth-quarter results, with both sales and earnings surpassing analysts’ expectations. The company’s performance is unlikely to have surprised users of TipRanks’ Website Traffic Tool.

The tool helps enhance stock research by providing data about the performance of a company’s website domain. This information can be used to predict the upcoming earnings report as a growth in online usage may point to higher sales in the concerned period.

Learn how Website Traffic can help you research your favorite stocks.

Website Traffic Showed Uptrend

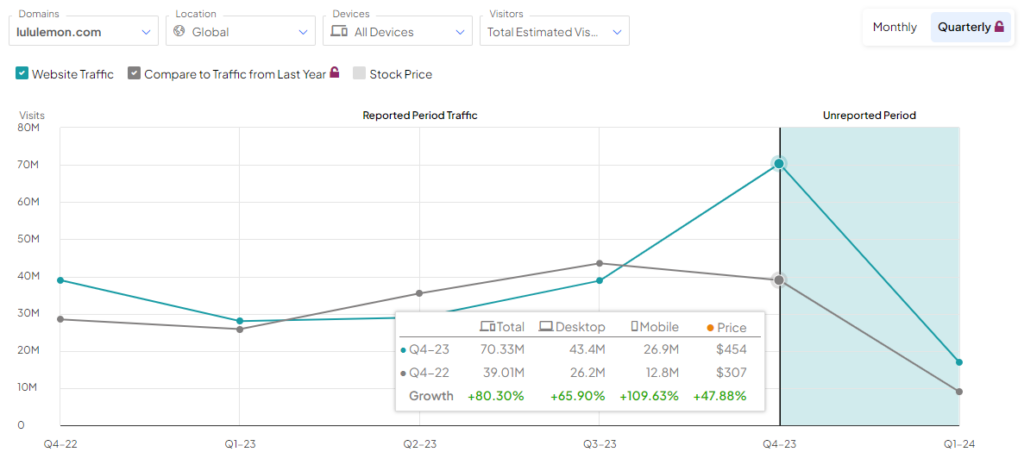

Ahead of Q4 earnings release, the website traffic tool showed that total estimated visits for lululemon.com increased by over 80% for the quarter compared to the same period last year. Moreover, it was up about 81% sequentially. The strong growth in website visits indicated that Lululemon would deliver an upbeat topline performance in the fourth quarter.

Eventually, LULU reported Q4 revenues of $3.21 billion, up 16% year-over-year. The company witnessed strong growth in international sales, particularly in China. Also, comparable store sales increased by 12% year-over-year.

Interestingly, the tool suggests that the positive momentum in demand for the company’s products has continued in Q1 as well. Quarter-to-date, total estimated visitors are up 87.4% from the same period last year.

The management expects to report Q1FY24 revenues in the range of $2.18 billion to $2.2 billion, compared with $2 billion reported in the same quarter last year. Meanwhile, EPS is expected to be between $2.35 and $2.40, up from $2.28 in the year-ago quarter.

Is LULU a Good Stock to Buy?

Lululemon’s shares have gained nearly 58% in the past year, outperforming the S&P 500 Index (SPX) rally of about 33%. Given this impressive rally, analysts’ average price target on Lululemon stock of $516.16 implies a limited upside potential of 7.79%.

Overall, Wall Street is cautiously optimistic about the company. It has a Moderate Buy consensus rating based on 15 Buy, three Hold, and two Sell ratings.

Concluding Thoughts

Lululemon’s focus on increasing brand awareness and introducing new products might continue to drive growth. Additionally, plans to expand its international presence have the potential to significantly boost the company’s top-line performance.