Shares of Lululemon (NASDAQ:LULU) fell in after-hours trading after the company reported earnings for its third quarter of Fiscal Year 2023. Earnings per share came in at $2.53, which beat analysts’ consensus estimate of $2.28 per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Sales increased by 18.3% year-over-year, with revenue hitting $2.2 billion. This beat analysts’ expectations by $10 million. In addition, comparable sales increased 13%, or 14%, on a constant dollar basis. It’s also worth noting that direct-to-consumer sales made up 41% of total sales, which was unchanged from Q3 2022.

Gross profit also increased, as it came in at $1.3 billion. This equates to a growth rate of 21%. Interestingly, though, income from operations decreased by 4% to $338.1 million on a GAAP basis. Nevertheless, Adjusted income from operations increased by 24% to $436.3 million.

Looking forward, management now expects revenue and adjusted earnings per share for Q4 2023 to be in the ranges of $3.135 billion to $3.170 billion and $4.85 to $4.93, respectively.

What is the Future of LULU Stock?

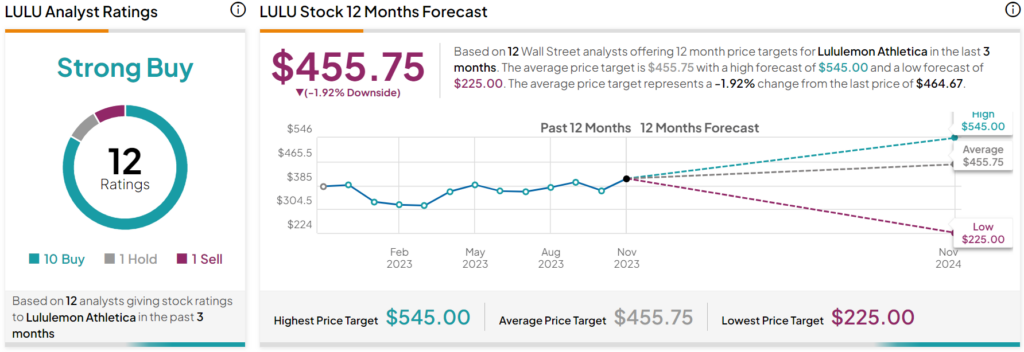

Turning to Wall Street, analysts have a Strong Buy consensus rating on LULU stock based on 10 Buys, one Hold, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, after a 43% rally this year, the average LULU price target of $455.75 per share implies 1.92% downside potential.