Lululemon Athletica (NASDAQ:LULU) recently announced organizational changes following the departure of its Chief Product Officer, Sun Choe. With this move, the company aims to bolster its growth, expedite product innovation cycles, and enhance the effectiveness of its go-to-market strategies. Despite the company’s strategic growth plans, LULU stock was down 4.4% at the time of writing.

Interestingly, LULU has opted not to look for a direct replacement for the chief product officer position. Instead, the company will establish a new team led by Nikki Neuburger as Chief Brand and Product Activation Officer. Neuburger will oversee merchandising, footwear, and product operations.

Among other changes, Jonathan Cheung, previously Global Creative Director, will assume the role of Head of Design, Innovation, and Product Development. Under the new role, Cheung will oversee both product development and design and will report directly to CEO Calvin McDonald.

Website Traffic Looks Promising

Under McDonald’s leadership, Lululemon has displayed robust performance, as reflected in a steadily increasing revenue base. This success can be attributed to the company’s strong brand name, loyal customer base, and strategic focus on continued international expansion.

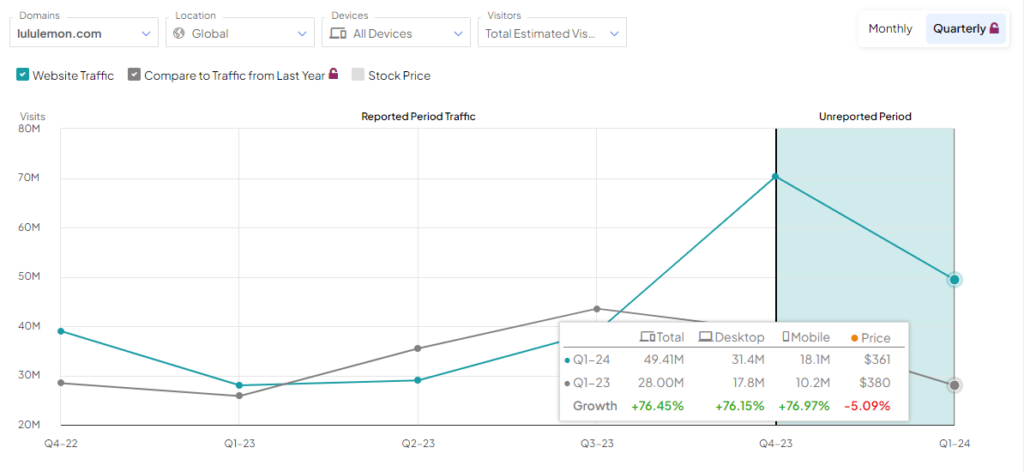

In fact, a look at Lululemon’s website traffic reflects significant growth in visitors. According to TipRanks data, website traffic in the first quarter (February-April) surged by 76.5% from the year-ago period. The rise in traffic indicates strong demand for the company’s products and paints a promising picture for top-line performance.

Learn how Website Traffic can help you research your favorite stocks.

Is LULU a Good Stock to Buy Now?

Overall, Wall Street is optimistic about the stock. Lululemon has a Strong Buy consensus rating based on 17 Buy, three Hold, and one Sell recommendations. The analysts’ average price target on LULU stock of $472.60 suggests an upside of 46.3%. Year-to-date, the stock is down 36.8%.

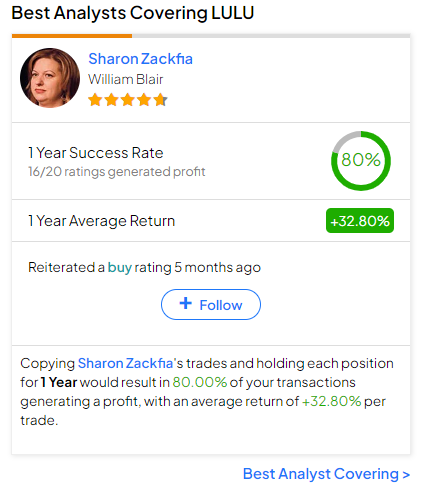

Interestingly, investors considering LULU stock could follow William Blair analyst Sharon Zackfia. She is the best analyst covering the stock (in a one-year timeframe), with an average return of 32.8% per rating and an 80% success rate. Click on the image below to learn more.