When analysts say it’s time for a reality check about certain stock prices, that’s likely to put a damper on at least some investors’ perspectives. That’s exactly what happened to clothing retailer Lululemon (NASDAQ:LULU). Lululemon shares lost a bit of ground in Tuesday afternoon’s trading following a downer update from an analyst.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The bad news came from Bernstein by way of analyst Aneesha Sherman, who noted that there was always a flaw in the logic around Lululemon. Investors seemed to expect constant top-line growth—itself a kind of fallacy; nothing improves forever—that was routinely over 20%. Moreover, the macroeconomic conditions that might have provided anything close to that growth shifted. A much more cautious customer is likely to stay away from buying a lot of Lululemon products, which is going to prompt the “reality check” Sherman suggests will hit.

However, even as Sherman expects problems, the situation won’t be a complete loss as she looks for 13% revenue growth this fiscal quarter. Further, Sherman also looks for a compound annual growth rate of 11% in the years to come and noted that while management has already accepted the decline in growth, the same can’t be said for investors.

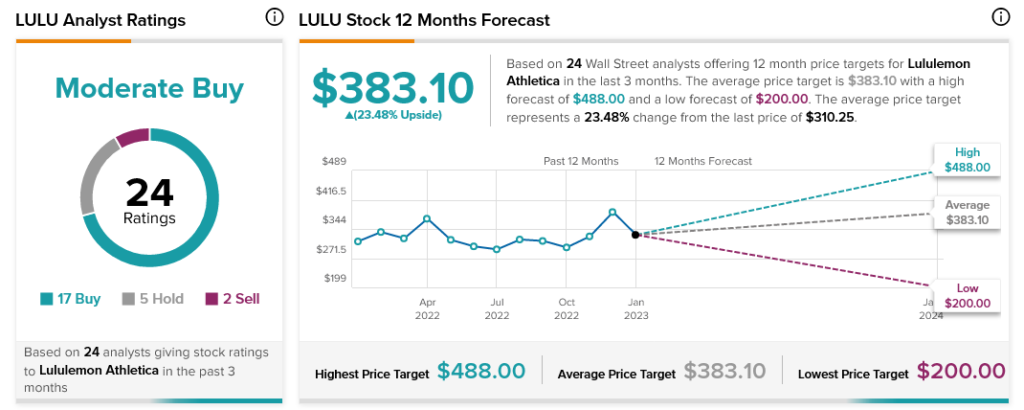

Analysts do largely hold out hope for Lululemon’s success, as consensus currently calls Lululemon stock a Moderate Buy. With an average price target of $383.10 per share, it has 23.48% upside potential.

Join our Webinar to learn how TipRanks promotes Wall Street transparency