Lucid Motors (NASDAQ:LCID) is facing a trademark showdown when it comes to its Gravity SUV, just before the EV company plans to start production. An EV charging company called Gravity, backed by Google (NASDAQ:GOOGL) ventures has filed a “petition for cancellation” with the U.S. Patent and Trademark Office’s Trademark Trial and Appeal Board (TTAB). Gravity has asked to revoke Lucid’s Gravity trademark.

Disputes & Q4 Disappointments

Startup Gravity alleges that Lucid’s adoption of its name may lead to customer confusion. Gravity, known for its EV charging business and previous use in a taxi fleet, raises concerns over brand identity related to Lucid’s branding choices. In response, Lucid refutes the allegation, expressing concerns over potential implications on brand reputation and goodwill.

Lucid is facing challenges in customer acquisition, reflecting in Q4 results with revenues dropping by 39% year-over-year to $157.2 million. The company now anticipates manufacturing 9,000 vehicles this year, considerably less than previous projections.

The company’s continued troubles have resulted in LCID stock crashing by more than 25% year-to-date.

Is Lucid a Buy or Sell?

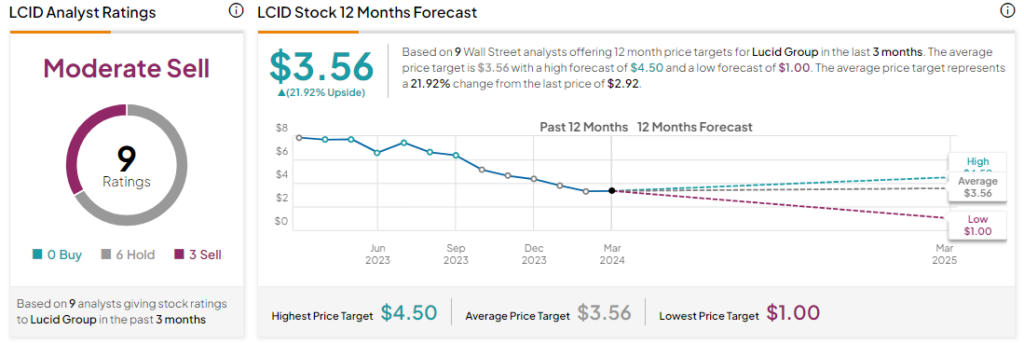

Analysts remain bearish about LCID stock with a Moderate Sell consensus rating based on six Holds and three Sells. The average LCID price target of $3.56 implies an upside potential of 21.9% at current levels.