Home supply stores like Lowe’s (NYSE:LOW) were pandemic darlings, as shoppers worked to improve their homes since they were spending so much more time in them, by government mandate, during the pandemic months. Once people were finally able to leave their houses, they did, which sent demand for home supplies lower. However, investors pushed Lowe’s stock higher today following its latest development: a loyalty program.

Dubbed “MyLowe’s Rewards,” it’s a program geared specifically to the do-it-yourself (DIY) crowd and comes with several benefits. Naturally, it comes with discounts—up to 5% on eligible purchases—but it goes beyond that as well. There will be free standard shipping on items bought online, access to workshops that provide insight on how to tackle DIY tasks, and a set of “exclusive perks” that really haven’t been named yet. Plus, the more shoppers spend with MyLowe’s Rewards, the more they’ll be able to get in return, which provides an incentive to shop with Lowe’s instead of shopping elsewhere.

It’s Worked Before

All the factors are in place to make this a winning program. Calling attention to DIY enthusiasts should be a particularly smart move as more and more people turn to fixing things themselves instead of calling on a plumber or the like at huge, inflation-driving service call rates. Plus, people will likely start being at home more often, as inflation-driven costs take most nights out off the table. It’s a plan that already worked once: Tractor Supply Company (NASDAQ:TSCO) launched its rewards program with solid results, and many already mention Lowe’s in the same breath as Tractor Supply. Thus, the idea that Lowe’s can benefit from using a tool that Tractor Supply did adds up.

Is Lowe’s a Buy, Sell, or Hold?

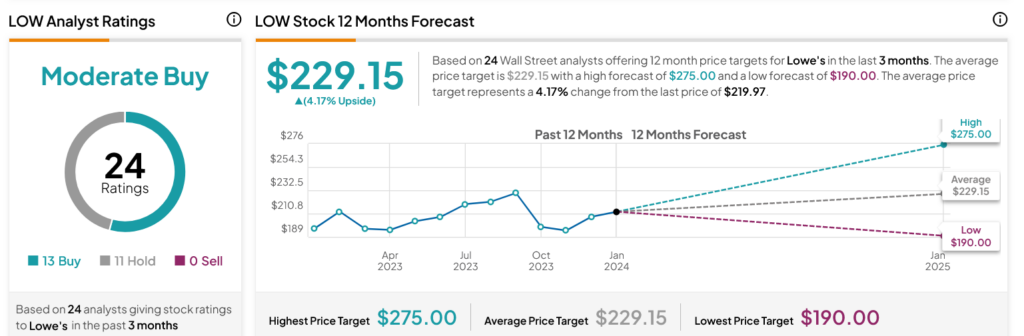

Turning to Wall Street, analysts have a Moderate Buy consensus rating on LOW stock based on 13 Buys and 11 Holds assigned in the past three months, as indicated by the graphic below. After a 3.5% rally in its share price over the past year, the average LOW price target of $229.15 per share implies 4.17% upside potential.