DraftKings (NASDAQ:DKNG) might have nothing to do with the current AI trend, but the stock has been one of the past year’s big winners. The shares have climbed 141% higher over the period, 29% of which have been generated in 2024.

With the company’s most recent Q4 results showing healthy top-line growth of 44%, and the online betting specialist increasing its fiscal year 2024 revenue guide from a prior range of $4.50 billion to $4.80 billion to between $4.65 billion to $4.90 billion, Needham analyst Bernie McTernan thinks that performance chimes well with current trends.

“The market seems to be putting a greater emphasis on growth now, and we believe DKNG has the best growth outlook in our coverage over the next 24 months, especially factoring in valuation and estimate risk reward,” McTernan said.

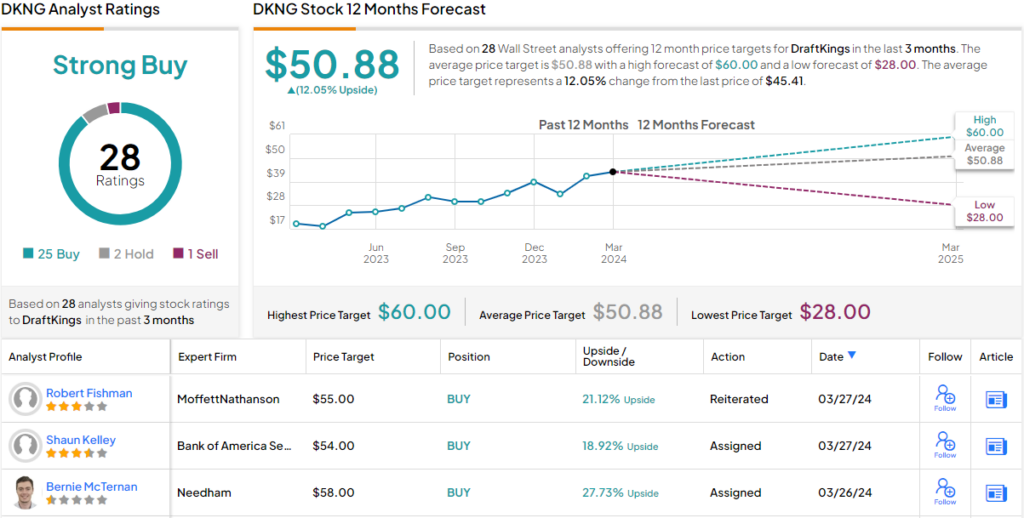

Accordingly, the analyst has added DKNG to his his Conviction List, while maintaining a Buy recommendation on the shares. Furthermore, he has adjusted his price target from $54 to $58, indicating a potential 28% upside in the months ahead. (To watch McTernan’s track record, click here)

In fact, while that represents McTernan’s base case, in a bullish scenario, boosted by better OSB hold and OSB legislation in Texas and California, McTernan sees a “credible path” for the stock to head back to the low $70s range, a peak level it last reached three years ago. “We note that if state launches do not come to fruition, we think there is upside risk to our estimates from lower promotion spend as the last year’s benign competitive environment could be extended,” McTernan went on to add.

McTernan also believes that during the past year, DKNG has demonstrated that it warrants comparison with prominent large cap, “emerging tech category leaders,” such as Uber, DoorDash, Airbnb and Roblox. Considering the company’s “longer path to profitability” compared to this group, DKNG appears pricey based on McTernan’s ’24E adjusted EBITDA estimate ($455.8 million). “However, valuation is more in-line in ’25E with peers despite faster assumed adj. EBITDA growth at DKNG,” says McTernan. “In ’26E, we think DKNG looks cheap relative to the group on adj. EBITDA, especially given our forecast for faster growth.”

Turning now to the rest of the Street, where McTernan has plenty of company when it comes to DKNG bulls. Based on a mix of 25 Buys, 2 Holds and 1 Sell, the stock claims a Strong Buy consensus rating. The average price target clocks in at $50.88, making room for 12-month growth of 12%. (See DraftKings stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.