Recent months have seen both good and bad news for the economy. On the positive side, the pace of inflation has come down from its post-pandemic highs, and appears to have leveled off near 3%. On the negative side, that remains higher than the Fed’s target rate, and combined with continued fiscal stimulus – read, high government deficit spending – it doesn’t leave much room for the Fed to cut back on interest rates.

The result, according to Morgan Stanley’s Mike Wilson, chief US equity strategist, is an environment in which stocks are gaining, but on a narrow base. The top 1% is reaping most of the benefits, and smaller stocks face higher risks.

Wilson sums up the issues, and a possible solution, noting: “The recent hotter than expected inflation reports suggest the Fed may not be able to deliver the necessary rate cuts for the markets to broaden out – at least until the government curtails its deficits and stops crowding out the private economy. Parenthetically, the funding of fiscal deficits may be called into question by the bond market when the reverse repo runs out later this year. Bottom line: despite investors’ desire for the equity market to broaden out, we continue to recommend investors focus on high-quality growth and operational efficiency factors when looking for stocks outside of the top five which appear to be fully priced.”

Wilson’s colleagues among the Morgan Stanley stock analysts are following his lead. Prominent among the ‘quality growth and operationally efficient’ shares they recommend are Disney (NYSE:DIS) and DraftKings (NASDAQ:DKNG). These stocks come from wildly different backgrounds and present investors with wildly different opportunities. However, a closer look at their details and the comments from Morgan Stanley may show just why the bank is tagging them.

Walt Disney

Let’s kick off with the globally recognized powerhouse, Disney. Founded in 1923, this iconic institution has evolved into a titan of entertainment beloved by audiences of all ages. Investors are certainly pleased, with Disney shares soaring by 26% year-to-date, riding the wave of this year’s bullish market trend.

The company’s business is built on three main segments: Disney Entertainment, ESPN, and Disney Experiences. The Disney Entertainment segment encompasses the company’s content and media businesses, including Disney Studios, Disney Streaming, and Disney Platform Distribution. Moreover, the Entertainment segment oversees the company’s iconic characters, songs, and associated spin-off products and marketing. Disney’s ESPN division covers the company’s sports content and other related products, including various sports experiences. The third division, Disney Experiences, includes the company’s theme parks in California, Florida, and internationally, as well as the Disney cruise line, and various consumer products, games, and publishing endeavors.

Disney’s journey has not been without its challenges. The company faced significant pressure following a string of movie flops last year and controversial content decisions. However, Disney’s confidence became evident when it reinstated its dividend in December, after suspending it in 2020. In its most recent declaration on February 7, the company announced a noteworthy 50% increase in the dividend payment, raising it to 45 cents per common share. This new, elevated dividend is scheduled for payment on July 25th.

The dividends alone would not have boosted the stock – but they were accompanied by a solid earnings report this past February, covering fiscal first quarter of 2024. The company reported revenue in the quarter of $23.5 billion, described as comparable to the prior-year first quarter, and just 1.1% off of expectations. The bottom line was better. At $1.22, the non-GAAP diluted EPS was up from 99 cents one year earlier – and it beat the forecast by 18 cents per share.

Morgan Stanley analyst Benjamin Swinburne talks about how Disney achieved these results, noting particularly that the parks remain a solid revenue generator, and that streaming is on track to turn profitable in the near-term. He writes, “We raise estimates and our PT to reflect a more rapid and confident path to streaming profits in the quarters and years ahead. By the end of FY24, the two most impactful businesses to DIS shares should be inflecting – with streaming turning profitable and Parks growth accelerating… Recent results, mgmt actions, and a stable macro increase our conviction in a multi-year ~20% adj. EPS CAGR outlook for Disney, w/ CY25 adj. EPS nearing $6.”

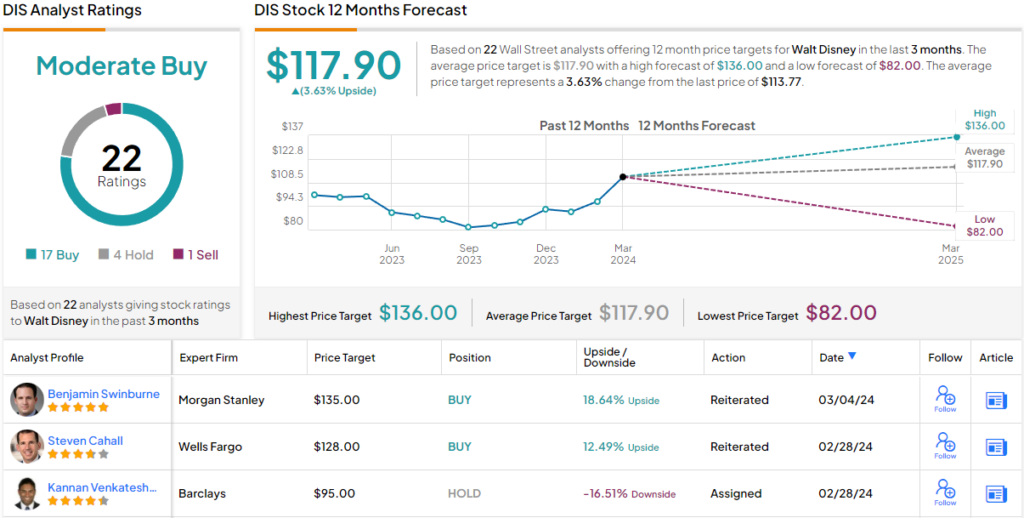

This is an optimistic bar, but Swinburne describes it as ‘realistic optimism,’ and gives the Disney shares an Overweight (i.e. Buy) rating, with a $135 price target that points toward a one-year upside potential of ~19%. (To watch Swinburne’s track record, click here)

Overall, DIS holds a Moderate Buy consensus rating from Wall Street analysts, derived from 22 ratings comprising 17 Buys, 4 Holds, and 1 Sell. The shares are priced at $113.40 and their average price target of $117.90 suggests a modest gain of ~4% in the next 12 months. (See Disney stock forecast)

DraftKings

The next Morgan Stanley pick is DraftKings, a fast-growing company from the world of online sports betting and fantasy sports leagues. The company is well-known for its online sportsbooks, which provide a full package of betting options for sports fans. These include coverage of most professional sports leagues, domestically and internationally, including football, baseball, basketball, hockey, and international soccer.

The company’s fantasy sports leagues give players options to build ‘dream teams’ and bet on their collective performances – fantasy gamers like having the results depend on their own pre-game choices. DraftKings operates in nearly half the states of the Union, and has begun expanding its activities to include some online casino gaming options.

Over the past few years, DraftKings has seen an upward trend in its revenues, based on the increasing popularity of online gaming in general and sports betting in particular. This is clear in the annual revenue totals; the company brought in $2.24 billion at the top line during 2022, and followed that with $3.66 billion in revenue for 2023. The company has followed a simple strategy to build this success: it builds on sports fans’ natural excitement for the games, and convinces them to place bets. It’s been a winning bet for DraftKings.

The company has made recent moves to expand that bet, through its acquisition agreement, announced in February of this year, with Jackpocket. Jackpocket is a leading player in the US online lottery segment, offering its customers a popular lottery app. DraftKings, under the agreement, will acquire Jackpocket for $750 million, with 55% of that paid in cash and 45% of the transaction conducted in stock. The deal is expected to close during the second half of this year, and DraftKings projects that, by fiscal 2026, Jackpocket will drive an additional $60 million to $100 million in adjusted earnings.

Those added earnings will come on top of what DraftKings already brings in. The company reported its fiscal fourth-quarter 2023 results in February, with a quarterly revenue of $1.23 billion, up 44% year-over-year. However, it fell $10 million short of the forecast. DraftKings ended both Q4 and 2023 with cash and liquid assets totaling $1.27 billion, an important factor to consider given the upcoming payments associated with the Jackpocket acquisition.

All of this led Morgan Stanley analyst Stephen Grambling to take an upbeat position on DKNG, writing of the sports betting company: “While 4Q results missed consensus expectations, guidance commentary combined with continued improvements in structural hold and its acquisition of Jackpocket revealed several factors that will continue to propel upside to DKNG consensus estimates… DKNG’s continued operational execution, inflection to positive FCF/EPS, and optimization of the balance sheet should continue to drive the stock higher.”

For Grambling, this adds up to an Overweight (i.e. Buy) rating, and his $49 price target implies an upside potential of ~10% on the one-year horizon. (To watch Grambling’s track record, click here)

Overall, there is a Strong Buy consensus rating on DKNG shares, based on 27 recent analyst reviews that break down to 24 Buys, 2 Holds, and 1 Sell. These shares are selling for $44.71 and their $49.15 average target price is practically the same as Grambling’s. (See DraftKings stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.