A class action lawsuit was filed against Lantheus Holdings (LNTH) on September 9, 2025. The plaintiffs (shareholders) alleged that they bought Lantheus stock at artificially inflated prices between February 26, 2025, and August 5, 2025 (Class Period) and are now seeking compensation for their financial losses. Investors who bought LNTH stock during that period can click here to learn about joining the lawsuit.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Lantheus develops, manufactures, and commercializes diagnostic medical imaging agents and radiopharmaceutical products primarily for the pharmaceuticals and biotechnology industry.

The company’s claims about possessing reliable information to project revenue and growth of its Pylarify product are at the heart of the current complaint. Pylarify is a radioactive diagnostic agent developed for positron emission tomography (PET) imaging, especially used for prostate-specific membrane antigen (PSMA) positive lesions in men with prostate cancer.

Lantheus’ Misleading Claims

According to the lawsuit, Lantheus and four of its senior executives (the Defendants) repeatedly made false and misleading public statements throughout the Class Period. In particular, they are accused of omitting truthful information about the company’s ability to properly evaluate pricing and competition for Pylarify, its most important product in the Radiopharmaceutical Oncology category, from SEC filings and related material.

In an earnings call held at the beginning of the Class Period, the President stated that Pylarify has been very successful, achieving over $1 billion in sales and being the leading PSMA PET imaging agent in the market. The company planned to increase both the number of units sold and overall sales revenue in 2025. Despite competition, Lantheus was confident it would keep the top market position and maintain a higher price compared to competitors.

Furthermore, during a May 7, 2025, conference call, the company’s Chief Commercial Officer (CCO) said Lantheus expects to keep benefiting from Pylarify’s unique clinical and commercial advantages to support its clear position as the market leader. They expected to keep expanding their contracts and maintain Pylarify’s higher price, despite competition.

During the same call, the CFO said they were lowering their growth expectations for Pylarify in 2025. Instead of expecting low to mid-single-digit percentage growth, they now expect flat to low single-digit growth for the full year.

However, subsequent events (detailed below) revealed that the defendants had failed to inform investors that the company did not have an accurate understanding of the pricing and competitive dynamics of Pylarify’s market.

Plaintiffs’ Arguments

The plaintiffs maintain that the defendants deceived investors by lying and withholding critical information about the company’s business and prospects during the Class Period. Importantly, the defendants failed to accurately evaluate Pylarify’s pricing and competition in forecasting the company’s revenue and growth estimates.

After partial disclosures in May, the information became clear on August 6, 2025, when Lantheus released disappointing results for the second quarter of fiscal 2025 and slashed growth expectations for fiscal 2025.

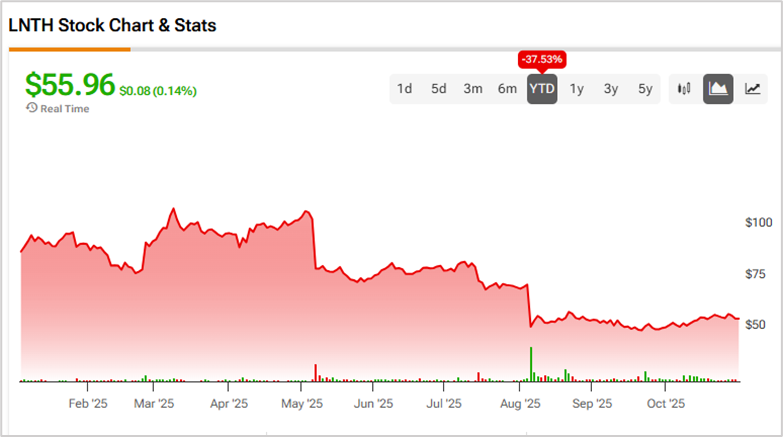

In Q2, Pylarify revenue fell 8.3% year-over-year due to losses from ongoing competition, impacting Pylarify’s pricing dynamics. The company also lowered its growth expectations significantly for Pylarify. Following the news, LNTH stock fell 28.6%.

To conclude, the defendants failed to inform investors that the company did not have an accurate understanding of the pricing and competitive dynamics of Pylarify’s market. Due to these issues, LNTH stock has lost 37.5% year-to-date.