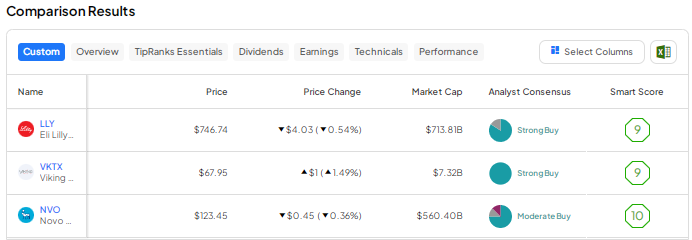

The breakthrough in weight-loss drugs has shaken the healthcare industry. Goldman Sachs Research expects weight-loss drugs to boost U.S. gross domestic product (GDP) by 0.4% in a baseline scenario with 30 million users and drive a 1% rise when users reach 60 million. Further, Goldman Sachs expects the weight-loss drugs market to reach $100 billion a year by 2030. Given the massive opportunity, we used TipRanks’ Stock Comparison Tool, to place Eli Lilly (NYSE:LLY), Viking Therapeutics (NASDAQ:VKTX), and Novo Nordisk (NYSE:NVO) against each other to pick the best weight-loss drug stock as per analysts.

Eli Lilly (NYSE:LLY)

Shares of pharma giant Eli Lilly have jumped more than 99% in the past year, thanks to optimism around the company’s weight-loss drugs. LLY’s weight-loss treatment, Zepbound, is based on tirzepatide, the active ingredient that is also present in its blockbuster diabetes drug Mounjaro.

Zepbound, which won the U.S. FDA’s (Food and Drug Administration) approval in November 2023, generated $175.8 million in revenue in Q4 2023. Analysts expect the drug to contribute revenue of $1.9 billion in the first year of sales itself.

Zepbound and Mounjaro mimic two naturally produced gut hormones, called GLP-1 (glucagon-like peptide 1) and GIP (glucose-dependent insulinotropic polypeptide), which help in suppressing appetite.

Aside from these rapidly growing drugs, Eli Lilly also boasts a diversified portfolio of treatments across oncology, immunology, and neuroscience.

Is Eli Lilly a Buy, Sell, or Hold?

Earlier this month, Erste Group analyst Hans Engel upgraded Eli Lilly stock to Buy from Hold, as the analyst expects the company’s revenue to rise by a high double-digit percentage this year. Engel expects further acceleration in the top line next year.

Additionally, Engel projects that LLY’s operating profit and net profit will grow at a faster rate than sales. He is particularly encouraged by the FDA’s approval of Zepbound for obesity treatment.

With 16 Buys and three Holds, Eli Lilly scores a Strong Buy consensus rating on TipRanks. The average LLY stock price target of $854.63 implies 14.5% upside potential.

Viking Therapeutics (NASDAQ:VKTX)

Shares of Viking Therapeutics have rallied more than 262% in the past year, with the company gearing up to challenge pharma giants Eli Lilly and Novo Nordisk in capturing the massive opportunity in the weight-loss drug market. Viking is a clinical-stage biopharma company focused on developing novel therapeutics for the treatment of metabolic and endocrine disorders.

In late March, Viking impressed investors by announcing positive results for its experimental weight-loss pill VK2735 in a Phase 1 study. The company added that it plans to commence a Phase 2 trial of the weight-loss drug later this year. This weight-loss pill is the oral version of VKTX’s weight-loss injection, for which the company reported encouraging mid-stage trial results in February.

It is interesting to note that Viking has another promising drug candidate, VK2809, in Phase 2 trial. It is an experimental therapy for non-alcoholic steatohepatitis (NASH).

Is VKTX Stock a Good Buy?

Earlier this month, analysts at Oppenheimer revealed their list of 24 smidcap stocks (small and mid-cap stocks with a market capitalization in the range of $1 billion to $10 billion), including Viking, which they believe have “untapped firepower.”

In late March, Oppenheimer analyst Jay Olson increased the price target for VKTX stock to $138 from $116 and reiterated a Buy rating on the stock after the company reported positive top-line results from the Phase 1 trial of oral VK2735. The analyst believes that the company has several options to explore additional dosing regimens and further enhance the safety and efficacy of VK2735.

Wall Street is highly bullish on Viking Therapeutics stock, with a Strong Buy consensus rating based on nine unanimous Buys. At $113.50, the average VKTX stock price target indicates 67% upside potential.

Novo Nordisk (NYSE:NVO)

Shares of Novo Nordisk have advanced 46% over the past year, fueled by the robust demand for the company’s Wegovy and Ozempic anti-obesity drugs. Semaglutide, a GLP-1 receptor agonist, is the primary active ingredient in Ozempic, Wegovy, and Rybelsus.

The massive demand for these weight-loss drugs has helped Denmark-based Novo Nordisk win about 60% of the GLP-1 market share. However, there are concerns about rising competition from Eli Lilly and other emerging players focused on developing weight-loss drugs.

Novo Nordisk received a further boost when in early March, the U.S. FDA approved Wegovy for cardiovascular risk reduction in adults with known heart disease and overweight or obesity. Several analysts are optimistic about the potential approval of the company’s weight-loss drugs in other therapeutic areas.

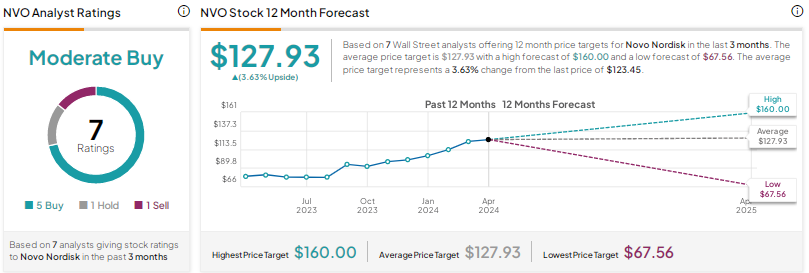

What is the Price Target for NVO Stock?

On April 12, BMO Capital analyst Evan Seigerman initiated coverage of Novo Nordisk stock with a Buy rating and a price target of $163.

The analyst cited several factors for his bullish sentiment, including the company’s promising in-development drugs for obesity and Type-2 diabetes and the acquisition of Catalent to enhance its manufacturing capabilities.

Wall Street has a Moderate Buy consensus rating on Novo Nordisk stock based on five Buys, one Hold, and one Sell. The average NVO stock price target of $127.93 implies a modest upside of 3.6% from current levels.

Conclusion

Wall Street is highly bullish on Eli Lilly and Viking Therapeutics but cautiously optimistic about Novo Nordisk. Currently, analysts foresee a higher upside potential in VKTX stock than the stocks of the other two weight-loss drugmakers.

Investors should understand that Viking is a high-risk, high-reward stock. It is a pre-revenue company that currently doesn’t have an approved product. Nonetheless, the potential approval of the company’s weight-loss drug could significantly boost its products, given the massive addressable market in this space.