Shares of hard-surface flooring retailer LL Flooring (NYSE:LL) gained nearly 8% today after F9 Investments proposed to acquire the company at $3 per share.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

F9 noted that the offer reflects “LL Flooring’s deteriorating financial and operational performance, as well as, the company’s Board’s refusal to meaningfully engage with F9 and its affiliates or allow it to perform basic due diligence, following F9’s previously announced acquisition proposal.”

Last week, LL’s third-quarter results were characterized by a nearly 20% drop in its revenue and a 20.5% decline in its total comparable store sales. In August, Thomas Sullivan, the Founder of LL and Cabinets to Go, had withdrawn a $5.76 per share takeover offer for the company.

Next, Thomas Sullivan plans to nominate three directors- Jason Delves, Jill Witter, and himself- to LL’s Board at the company’s 2024 annual meeting.

Last month, investment firm Live Ventures (NASDAQ:LIVE) offered to acquire LL for nearly $180 million. LL began exploring strategic alternatives in August, and the $5.85 per share offer from Live Ventures is well above Thomas Sullivan’s current proposal as well as his previous takeover offer. LL’s Board is currently reviewing the proposal from Live Ventures, and its reaction to the latest proposal from F9 remains pending.

Is LL Stock a Good Buy?

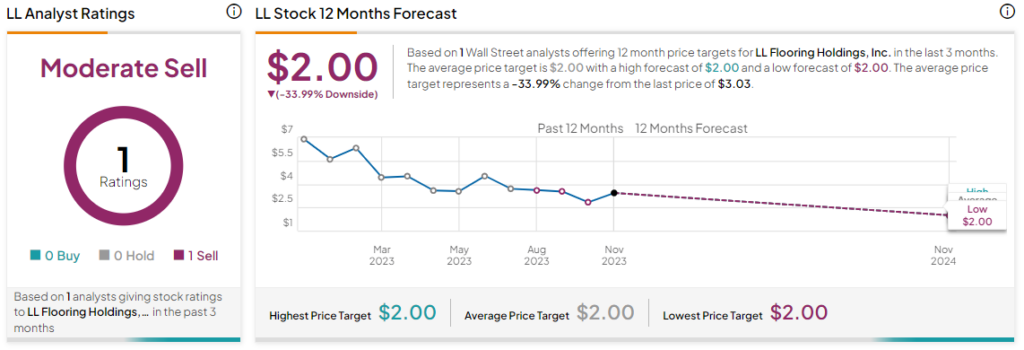

Meanwhile, LL Flooring’s share price has declined by nearly 59% over the past year. Loop Capital’s Laura Champine, the lone analyst covering LL Flooring, has reiterated a Sell rating on the stock. Champine’s LL price target of $2 implies a further 34% potential downside in the stock.

Read full Disclosure