Entertainment company Live Nation Entertainment (NYSE:LYV) is facing legal action from the U.S. Department of Justice (DOJ) and a group of states, Bloomberg reported. The imminent lawsuit is expected to accuse LYV of antitrust violations and seek the separation of its ticket sales and distribution subsidiary, Ticketmaster. Following the news, LYV stock was down 6.4% in after-hours trading yesterday.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The lawsuit stems from the Justice Department’s investigation that began in 2022.

Brief Background of LYV and Ticketmaster

Live Nation merged with Ticket Master in 2010. The deal was approved by authorities on the condition that Live Nation would refrain from discriminatory practices against concert venues that chose not to utilize Ticketmaster’s services.

However, subsequent probes raised concerns that Live Nation repeatedly violated the terms of this agreement. Additionally, both Live Nation and Ticketmaster faced continued criticism over high service fees, inadequate customer service, and potentially anti-competitive practices.

Further, the mishandling of tickets to Taylor Swift’s “Eras Tour” concert by Ticketmaster in 2022 fueled concerns about the company’s dominance in the ticketing industry.

LYV’s Risk Analysis

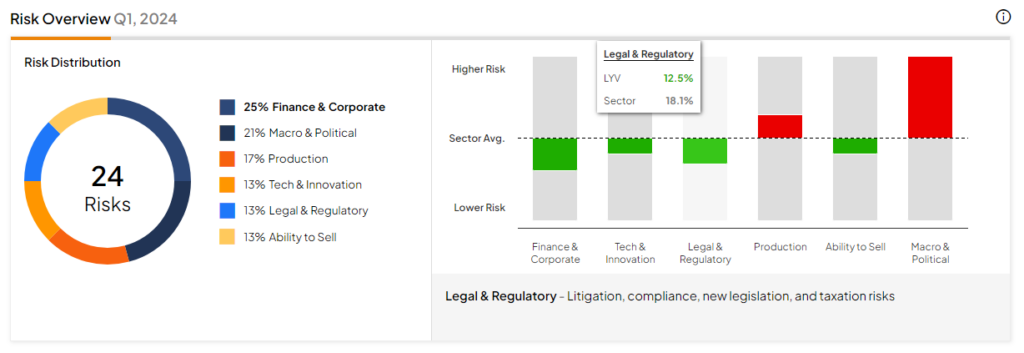

Despite the company’s constant involvement in legal investigations, TipRanks’ Risk Analysis tool shows that Live Nation’s legal and regulatory risk exposure is lower than the industry average. The legal and regulatory risk category accounts for 12.5% of its total risks, compared with the industry average of 18.1%.

What Is the Price Target for LYV?

On TipRanks, Live Nation has a Strong Buy consensus rating based on 15 unanimous Buy ratings assigned in the past three months. After a 15.7% surge in its share price over the past six months, the analysts’ average price target on LYV stock of $121.15 per share implies a 19.48% upside potential.

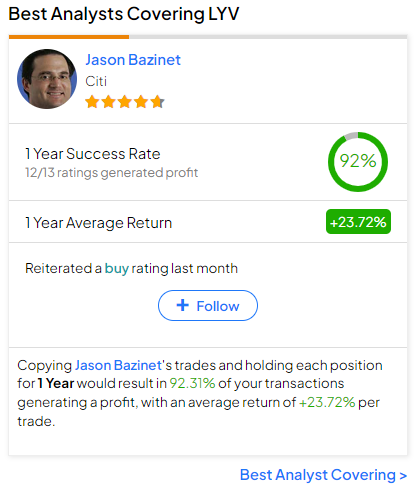

Importantly, investors considering LYV stock could follow Citigroup (C) analyst Jason Bazinet. He is the best analyst covering the stock (in a one-year timeframe), with an average return of 23.72% per rating and a 92% success rate. Bazinet, who ranks among the top 1% of Street stock experts, reiterated his Buy rating on Live Nation stock on April 17. (To watch Bazinet’s track record, click here.)