The stock of Canadian miner Lithium Americas (LAC) is down 12% on Sept. 26 following an epic rally that saw the company’s share price double in only a few days.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

LAC stock appears to be coming back to Earth after the Vancouver-based company’s share price skyrocketed in recent days. Even with the 12% decline on Sept. 26, the stock is still up 100% in the last five trading sessions.

The catalyst for the explosive growth has been speculation that the administration of U.S. President Donald Trump is negotiating a stake in the company. The U.S. government has reportedly proposed taking a 10% equity stake in the company in exchange for providing Lithium Americas with a $2.3 billion Energy Department loan.

Government Investment

While no deal with the U.S. government has been finalized or publicly announced, rumors of such an arrangement have been enough to send LAC stock surging. Lithium Americas is currently developing a lithium mine in Nevada to extract the mineral that is critical for developing electric vehicle batteries.

Lithium Americas has said that it remains in discussions with the U.S. government about the terms of the loan. A potentially complicating factor in a U.S. government equity stake is that Lithium Americas is based in Canada.

Still, the U.S. government has announced stakes in several publicly traded companies this year, including a 10% equity position in chipmaker Intel (INTC) and a $400 million investment in rare earth miner MP Materials (MP).

Is LAC Stock a Buy?

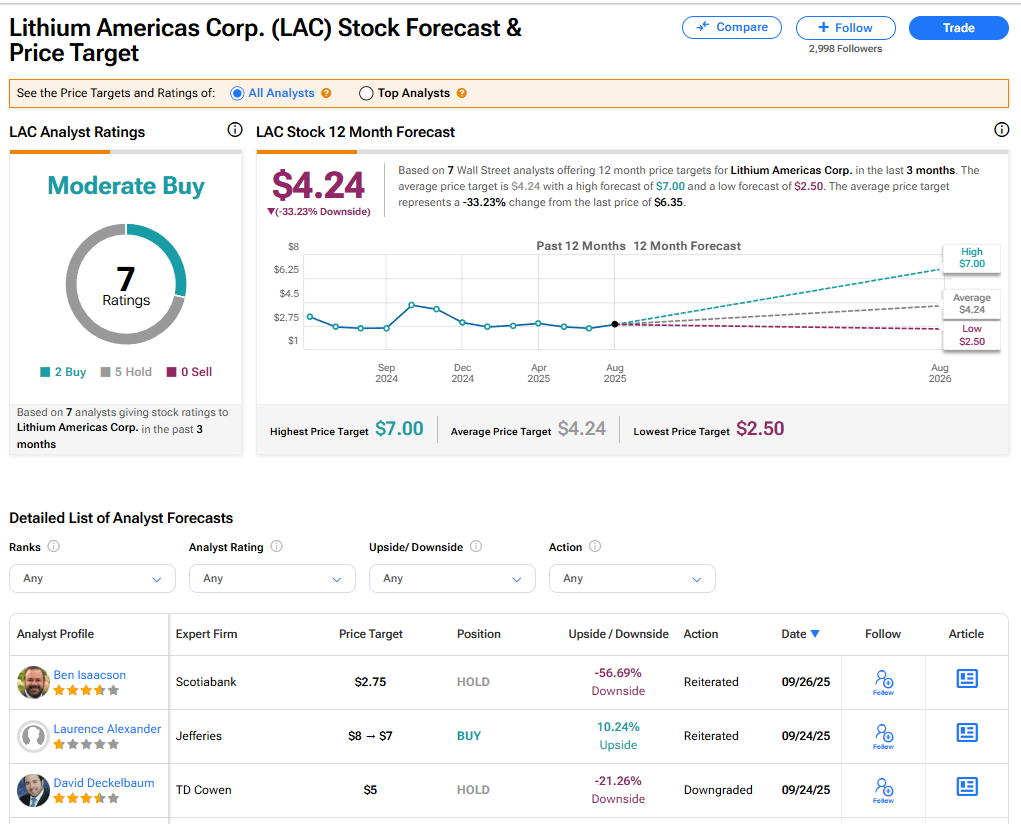

The stock of Lithium Americas has a consensus Moderate Buy rating among seven Wall Street analysts. That rating is based on two Buy and five Hold recommendations issued in the last three months. The average LAC price target of $4.24 implies 33.23% downside from current levels.