The shares of giant chip foundry Taiwan Semiconductor Manufacturing (TSMC) (TSM) failed to sparkle during early trading on Thursday, sustaining downward pressure from the previous day.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

This is despite the fact that Taiwan Semiconductor, the world’s biggest contract chip manufacturer, a day earlier, unfolded its AI-powered software chip design that could possibly resolve the high-energy dilemma that continues to haunt the production of powerful AI chips. The new design is expected to result in chips that are more energy-efficient compared to the current versions in the market.

However, investors in the Taiwanese foundry, which manufactures chips designed by companies such as Nvidia (NVDA), appear not to have been ignited by the news. TSMC stock fell nearly 3% to about $273 in pre-market trading on Thursday, as of 9:00 a.m. EDT, extending the nearly 1% loss of value the shares recorded at the closing bell the previous day.

Taiwan Semi Eyes Improved Chip Design

Taiwan Semiconductor, which unveiled the new design strategies at a conference in Silicon Valley, said it expects chips produced based on them to be 10 times more energy efficient, according to Reuters. The new design relies on automation software that stacks several smaller chips into one, making them work together as a team.

The new strategies are a product of TSMC’s partnership with American integrated circuit (IC) automation software providers Cadence (CDNS) and Synopsys (SNPS). The collaboration has involved the companies developing AI-powered automated chip design tools, advanced chip stacking techniques (or 3D-IC), reusable chip components, and photonics-based circuits to drive advancements in semiconductor manufacturing.

Furthermore, Taiwan Semiconductor said it tested new AI features that automatically fix chip design errors and help engineers complete AI chip designs faster and more efficiently. This feature will be available on TSMC’s two-nanometer node, one of its new chip-making technologies.

Big Tech Pursues Energy-Efficient AI Chips

Meanwhile, the partnership comes as tech giants are themselves investing in technology to make AI chips less energy-draining. This week, Microsoft (MSFT) disclosed successfully testing a new cooling system that removes heat in chips up to three times more effectively compared to the available cooling systems. On the other hand, Nvidia has also been working on a photonic (or light-based) technology that could use laser beams to cut down energy usage by its chips.

Is TSMC a Risky Investment?

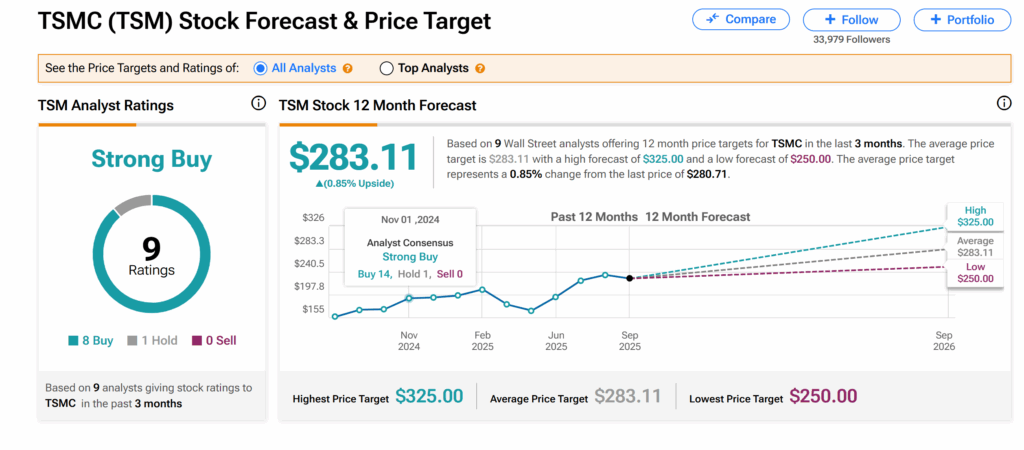

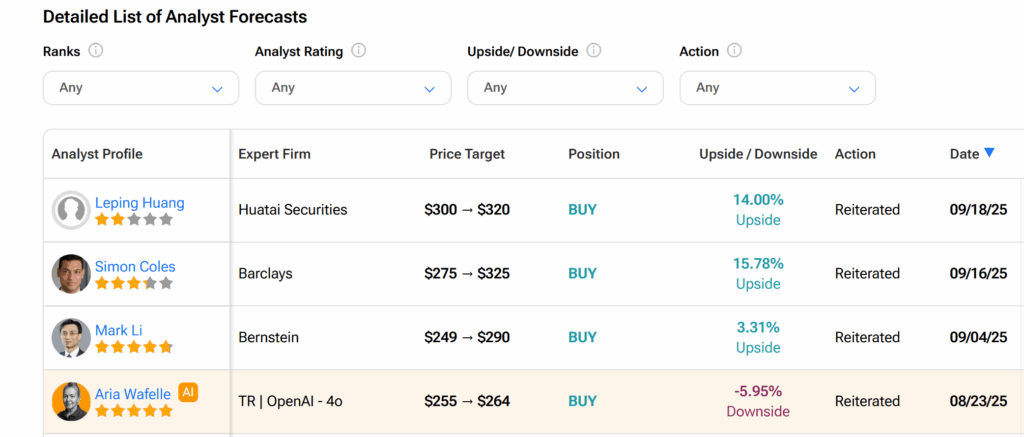

Turning to Wall Street, Taiwan Semiconductor’s shares currently have a Strong Buy consensus recommendation on TipRanks. This is based on eight Buys and one Hold assigned by nine Wall Street analysts over the past three months.

Moreover, the average TSMC price target of $283.11 suggests a potential 0.85% growth from the current level.