The AI boom is creating major environmental concerns, especially as companies like chipmaker Nvidia (NVDA) continue to dominate the market. In Taiwan, where much of the chipmaking actually happens, over 80% of power comes from coal, oil, or gas. As a result, Greenpeace reports that electricity used for AI chip production rose more than 350% between 2023 and 2024, and now equals the annual power use of nearly 93,000 homes in Taiwan alone.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Nevertheless, Wall Street remains highly optimistic about Nvidia ahead of its earnings report this week. The company, which controls roughly 80% of the AI chip market, is expected to report strong results thanks to rising demand from companies that are building AI tools. “Nvidia is the one chip player fueling the AI Revolution,” said Wedbush analyst Dan Ives. But that growth comes with a cost that is becoming harder to overlook.

The data centers that run AI models like ChatGPT, Meta’s (META) Llama, and Google’s (GOOG) AI systems need enormous amounts of power. Indeed, The New York Times estimates that by 2027, global AI electricity use could match Argentina’s entire national usage. This has led the World Economic Forum to say that this is a serious issue and urges tech companies, energy providers, and governments to work together to make data centers more sustainable.

Is NVDA a Good Stock to Buy?

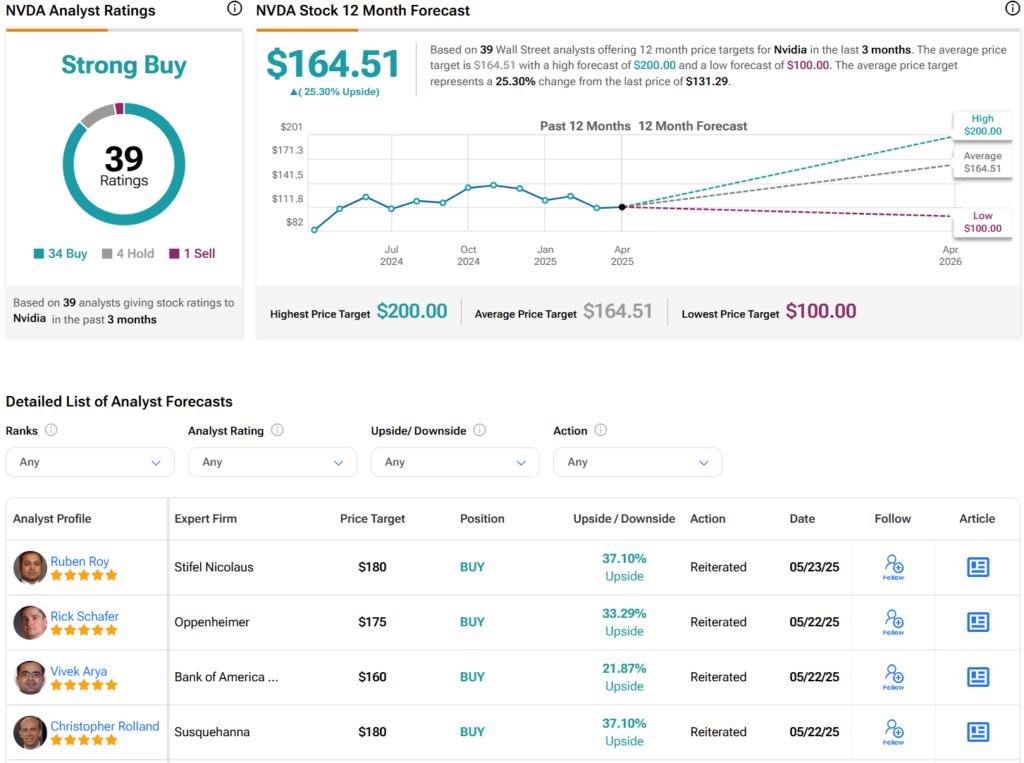

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 34 Buys, four Holds, and one Sell assigned in the past three months, as indicated by the graphic below. Furthermore, the average NVDA price target of $164.51 per share implies 25.3% upside potential.