Levi Strauss (NYSE:LEVI) reported mixed Q4 financials. While its top line fell short of Wall Street’s expectations, its bottom line came marginally ahead of estimates. However, LEVI stock dropped 1.6% in Thursday’s after-hours trading session as the company provided a lower-than-expected Q1 profit outlook. Further, the company is eyeing cost savings and expects to cut jobs in the first half of 2024.

Levis expects to report adjusted EPS in the range of $1.15 to $1.25 in Q1 of 2024, compared to the Street’s projection of $1.33 a share.

Let’s dig deeper.

Q4 Results

Levi Strauss delivered net revenues of $1.6 billion in Q4, up 3% year-over-year. However, it fell marginally short of analysts’ average estimate of $1.66 billion. The strength of its Direct-to-Consumer (DTC) and e-commerce platforms was partially offset by weakness in the wholesale segment, primarily in Europe.

The company delivered adjusted EPS of $0.44, up 29% year-over-year. Further, it compared favorably with analysts’ earnings estimate of $0.43 per share.

Levi Strauss Eyes Cost Savings

Levi Strauss announced a new global productivity initiative, Project FUEL, to turn around its business. The company expects to accelerate the execution of its “Brand Led and DTC First” strategies while fueling long-term profitable growth. This two-year initiative will focus on optimizing the operating model and structure of the company, redesigning its business processes, and identifying opportunities to reduce costs.

The productivity initiative will generate net cost savings of $100 million in 2024. Further, as part of this plan, Levi Strauss expects to reduce its global corporate workforce by 10% to 15% in the first half of 2024.

It remains to be seen how the company’s productivity initiative contributes to its financials.

Is LEVI a Buy, Sell, or Hold?

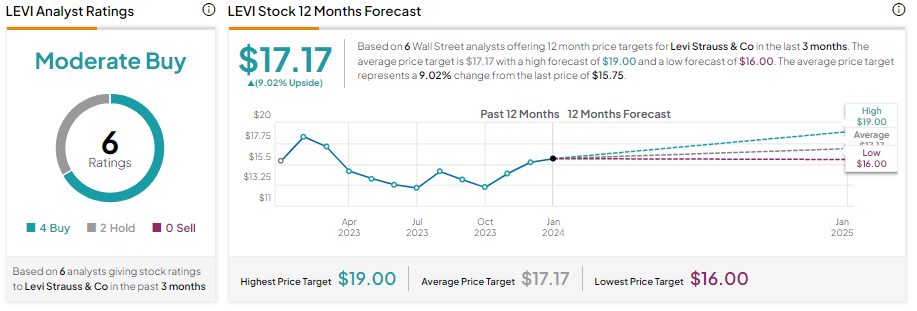

Wall Street is cautiously optimistic about LEVI stock. It has a Moderate Buy consensus rating, reflecting four Buy and two Hold recommendations.

Analysts’ average price target of $17.17 implies 9.02% upside potential from current levels.